Most investors are not aware of how many corporate managers destroy shareholder value because accounting rules allow them to erase their mistakes from financial statements. A little-known accounting trick called an “asset-write down” allows managers to simply remove assets and shareholders’ equity from the balance sheet as if they never existed. It gets worse: this trick can be employed only when the current fair value of the asset falls below the book value of the asset. In other words, when managers have bought assets that are now worth less than their depreciated value, they can, with the stroke of a pen, remove those assets and the shareholders’ equity that funded their purchase from the balance sheet. Effectively, this accounting loophole allows managers to hide their failures and makes it exceedingly difficult for investors to learn how much value they have destroyed. Write-downs also artificially inflate accounting profitability metrics and can make companies with lots of write-downs look more profitable than companies with no write-downs.

- Given that managers are paid to create value, not destroy it, asset write-downs reflect management incompetence and failure to allocate capital effectively.

- Investors must beware companies that report artificially high profits due to the asset-write-down loophole.

Only 53 of the current S&P 500 companies have no write-downs. The other S&P 500 companies wrote down more than $920 billion. 137 companies have written down more than $1 for each dollar on their balance sheets. In other words, management of these companies has, over time, caused the value of assets it has acquired to decrease so much that the cumulative value destroyed exceeds the value of all their assets currently. Managers are paid to create, not destroy value. It is hard to believe that the managers responsible for such an abysmal capital allocation track record will create enough shareholder to reward investors.

Our latest “red flag” report: Asset Write-Downs Reveal Risk (request access to this report via research@newconstructs.com), delivers the companies with the most asset write-downs and how those write-downs affect the reported profitability. We highlight the management teams that have destroyed the most value and have failed investors worst.

Not surprisingly, asset write-downs are hard to find and require expertise in Financial Footnotes to identify. Companies use a wide variety of code names when reporting them, and companies often only report them in the Financial Footnotes. Based on our analysis of over 50,000 filings, we have identified an alarmingly large variety of terms that identify asset write-downs. Below are some samples:

- Non-recurring write-down of inventory

- Write-down of capitalized or deferred costs

- For more samples see our report: Asset Write-Downs Reveal Risk (request access to this report via research@newconstructs.com)

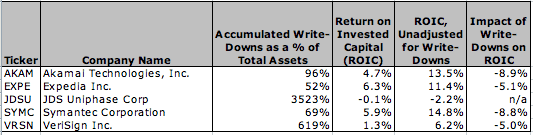

Figure 1 below provides a sample of value destroyers in the S&P 500. The stats are hard to believe. For example, Verisign (VRSN), over the past 12 years, has written off $6.19 for every dollar on its current balance sheet. That is a lot of shareholders’ equity gone to waste. Over the past 10 years, JDS Uniphase (JDSU) has written-off $35.23 for every dollar on its balance sheet today…not a track record that gives confidence for value creation in the future. Note that the impact of write-downs on JDSU’s ROIC is “n/a” because the company has a negative ROIC.

Figure 1: Value Destroyers in the S&P 500

Sources: New Constructs, LLC. and company filings

Sources: New Constructs, LLC. and company filings

There are many other companies like the ones in Figure 1.

Investors who like to do their diligence on companies before buying their stock will find our report Asset Write-Downs Reveal Risk (request access to this report via research@newconstructs.com) helpful.

4 replies to "Red Flag Report: Hidden Management Failures: Asset-Write Downs"

[…] does not bode well for their ability to create shareholder value. Our recent article on Management Failures explains why investors need to beware large asset-write-downs like those incurred […]

[…] does not bode well for their ability to create shareholder value. Our recent article on Management Failures explains why investors need to beware large asset-write-downs like those incurred […]

[…] released Red Flag Reports on hidden debt from off-balance sheet operating leases and management failures related to asset write-downs, be on the lookout for more Red Flag Reports from New Constructs. Future reports will focus on […]

[…] One of the issues weighing down the investment merit of MU is the amount of write-downs management has taken over the past 13 years. Specifically, and as detailed in our report, MU’s management has written down over $3bn in assets, that equals 25% of the company’s current reported net assets. In other words, MU’s management has written down 25 cents of every dollar that investors have trusted them with. As detailed in our report “Hidden Management Failures: Asset Write-Downs”: […]