Investors in Financial Sector ETFs needs to be very careful about which ETF they buy because there are simply not that many good stocks as compared to bad stocks in the sector. The Financial sector is one of 5 that gets our Neutral rating. 4 sectors get our Dangerous rating while only one gets an Attractive Rating. See our U.S. Equity ETF Strategic Roadmap report to compare our ratings on all sectors and the major index ETFs.

Not all Financial Sector ETFs are made the same. They all tend to hold different companies and a different number of companies. For example, according to Marco Polo XTF, four of the top six ETFs by market cap all have vastly different numbers of holdings. Select Sector SPDR-Financial (XLF) has 81 cap-weighted holdings, RYF has 81 equal-weighted-holdings, Vanguard Financial Index Fund (VFH) has 492 cap-weighted holdings, iShares Dow Jones US Financial Sector (IYF) has 258 cap-weighted holdings and , iShares Dow Jones US Financial Services (IYG) has 119 cap-weighted holdings. Other ETFs in the sector (Rydex S&P Equal Weight Financial – RYF and RevenueShares Financials Sector Fund – RWW) have the same number of holdings as XLF, but one is equal weighted and the other is revenue weighted. The point is that depending on the holdings and the allocations for a given ETF, the ETF can have radically different performance. After all, that is what professional managers are paid to do.

Accordingly, passively-managed ETFs put the burden of stock-selection diligence on the investor.

I am not saying that investors need professional managers to build custom ETFs. But I am saying that investors need to understand the holdings and allocations to each holding within an ETF in order to be sure they are getting what they want from the ETF.

Below are our recommendations:

If you require exposure to the Financials sector:

We recommend investors buy only the Very Attractive and Attractive stocks in the Financials sector, not a Financials ETF. 78% (in terms of market value) of stocks in the Financial Sector are Neutral-or-worse- rated stocks. This compares poorly to the Consumer Staples Sector, where 73% (in terms of market value of stocks) of stocks get and Attractive-or-better rating.

If you require exposure to a sector ETF:

We recommend investors buy a Consumer Staples ETF over a Financials ETF because the Consumer Staples sector allocates 73% of the value to Attractive-or-better-rated stocks compared to 21% for the Financials sector.

If you require exposure to a Financials ETF or an index ETF:

We recommend investors buy an S&P 500 ETF instead of a Financials ETF.

The following figures explain my conclusions above.

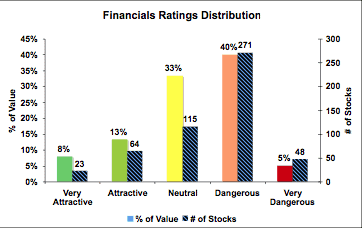

Figure 1 maps the Risk/Reward Rating composition of the Financials sector’s holdings and capital allocation.

Sources: New Constructs, LLC and company filings

Sources: New Constructs, LLC and company filings

The Financials sector has only 21% of its value invested in Attractive-or- better-rated stocks while 78% of its value is invested in Neutral-or-worse- rated stocks. Therefore, investors should be sure that they assess the holdings of any Financial sector ETF to ensure it is not too heavily weighted in Neutral-or-worse-rated stocks. Financial Sector ETFs could offer investors a more attractive Risk/Reward profile by (1) adding Attractive-rated holdings in place of Neutral-or-worse-rated holdings and/or (2) allocating more capital to the Attractive-rated holdings instead of Neutral-or-worse-rated holdings.

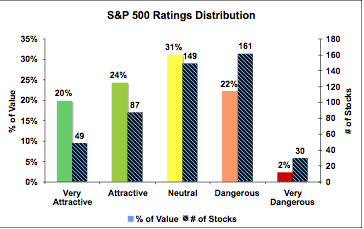

Figure 2 maps the Risk/Reward Rating composition of the S&P 500 and its capital allocation.

Sources: New Constructs, LLC and company filings

Sources: New Constructs, LLC and company filings

The S&P 500 allocates 44% of its value to Attractive-or-better-rated stocks while the Financials sector allocates 21% of its value to Attractive-or- better-rated stocks. The S&P 500 allocates only 24% of its value to Dangerous-or-worse-rated stocks while the Financials sector allocates 45% of its value to Dangerous-or-worse-rated stocks.

Comparing their ratings distributions, the S&P 500 shows a better allocation of capital and is a more appealing option for investors looking to buy an ETF. For example, the Financial Sector allocates twice as much value to ‘very dangerous’ stocks and nearly twice as much value to ‘dangerous’ stocks.

More details are available in our report on Financial Sector ETFs.

This analysis and our conclusions are based on bottoms-up analysis of each of the 3000 stocks we cover, including nearly every financial sector company. Our individual company research leverages detailed review of Financial Footnotes and MD&A in SEC filings to deliver clients the whole truth about the profitability and valuation of every stock.