If you want to be in a sector ETF, the Consumer Staples Sector is the only place to shop. Compared to the nine other major sectors (per our US Equity ETF Strategic Roadmap report), this sector has by far the best companies and the most market value allocated to the best companies. However, not all ETFs are made the same. Despite the predominance of Attractive-rated stocks in the Consumer Staples Sector, there are still ETFs that investors should be careful to avoid. Figure 1 shows how the Consumer Staples Sector’s stocks and the market value attributed to them stack up under the microscope of our risk/reward stock rating system.

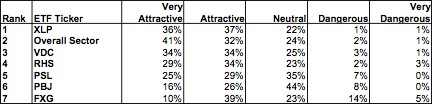

Figure 1: Consumer Staples Sector – Capital Allocation & Holdings by Risk/Reward Rating

Sources: New Constructs, LLC and company filings

The Consumer Staples sector has only 3% of its value invested in Dangerous-or-worse-rated stocks and 73% of its value invested in Attractive-or-better-rated stocks. The Consumer Staples sector is the only sector that has an Attractive Overall Risk/Reward Rating because of its superior allocation to Attractive-or-better-rated stocks.

The key takeaway here is that it would seem difficult for investors to go wrong when selecting a Consumer Staples ETF because there are few Dangerous or Very Dangerous stocks, and, those stocks have very little market value. A Consumer Staples ETF would have to allocate more value to small Dangerous or Very Dangerous stocks to be worse than the overall sector.

To test our theory, we analyzed the holdings and allocations for the top 6 Consumer Staples ETFs (listed below) by market cap according to Marco Polo XTF.

- Select Sector SPDR-Consumer Staples (XLP): 40 cap-weighted holdings

- Vanguard Consumer Staples Index Fund (VDC): 109 cap-weighted holdings

- PowerShares Dynamic Food and Beverage (PBJ): 30 cap-weighted holdings

- PowerShares Dynamic Consumer Staples Sector (PSL): 59 equal-weighted holdings

- Rydex S&P Equal Weight Consumer Staples (RHS): 41 equal-weighted holdings

- First Trust Consumer Staples AlphaDEX Fund (FXG): 37 holdings weighted according to “Various Fundamentals”

The first thing I noticed was that each of the ETFs has a meaningfully different number of holdings and, therefore, different allocations to holdings as well. Right away, I knew that given the differences in holdings and allocations, these ETFs would likely perform quite differently.

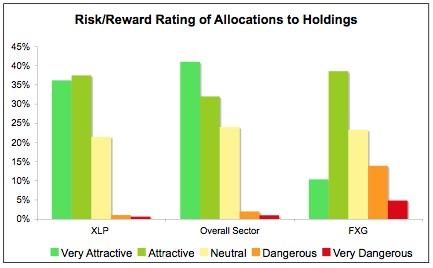

Figure 2 shows how the Consumer Staples sector ETFs stack up versus each other and the overall sector based on risk/reward of their allocations.

The Good:

XLP – the only Consumer Staples Sector ETF to rank better than the overall sector. Therefore, the only ETF we would recommend is XLP.

The Bad:

The other 5 ETFs found a way to allocate the value of the fund in a way that makes them less Attractive than the overall sector. We recommend investors buy the Very Attractive and Attractive stocks in this sector before buying any of the consumer Staples ETFs except XLP.

Figure 2: Comparing The Allocations of the Consumer Staples Sector ETFs Sources: New Constructs, LLC; Marco Polo XTF and company filings

Sources: New Constructs, LLC; Marco Polo XTF and company filings

The Ugly:

We recommend investors avoid FXG, which allocates significantly more value to Dangerous and Very Dangerous-rated holdings and much less to Attractive and Very Attractive-rated holdings. Figure 3 highlights just how different that FXG is compared to XLP and the overall sector. Given how few and the small market value of the Dangerous and Very Dangerous-rated stocks in the Consumer Staples Sector, one has to wonder how First Trust Advisors LP, the issuer of FXG, determined it should allocate so much value to Dangerous and Very Dangerous-rated holdings. Marco Polo XTF defines their index composition strategy as based on “Various Fundamentals”. They are certainly not looking at the same fundamentals as we. Perhaps, they are overlooking the key data from Financial Footnotes that we painstakingly gather and analyze.

Figure 3: The Good and the Ugly In Consumer Staples Sector ETFs

Sources: New Constructs, LLC; Marco Polo XTF and company filings

Sources: New Constructs, LLC; Marco Polo XTF and company filings

2 replies to "The Good, the Bad and the Ugly In Consumer Staples ETFs"

I currently see weakness in XLP and Staples in general. I have been noticing and commenting on its weakness since early January in the Daily Report. Consumer Seems to be weak with Technology and Energy taking leadership. What may be the trigger to have price realize this attractive rating?

Our focus is on the underlying profitability ad valuation of stocks; so we do not attempt to ‘time’ the market. We assume that the markets are efficient enough to recognize the true profitability and valuation of stocks: maybe sooner rather than later, but eventually always. It is hard to know exactly when that will happen but as long as markets remain semi-efficient, our system should continue to work.

now, more to your question: tech stocks have certainly been hot/popular, which is why their current valuations offer less upside potential.

The likely trigger(s) for the market to recognize the relative undervaluation of the Consumer Staples stocks:

1. better-than-expected earnings

2. more attractive valuations