We closed this position on August 8, 2011. A copy of the associated Position Update report is here.

The worst is not over for Finisar Corporation (FNSR)’s stock. Despite dropping over 50% since March, the stock remains on our most dangerous stocks list, where it has been since October 2010.

Like all of our “most dangerous” stocks, FNSR is guilty of both misleading earnings and an undeservedly-high stock valuation.

Yes, the valuation is still mind-bogglingly high despite dropping about 50% since March.

The current stock price of ~$20.44 implies the company’s after-tax operating profits (NOPAT) will grow by nearly 30% for 10 years in a row. To put this in perspective, only three non-biotech companies with market caps > $5b have done this in the past 9 years eBay (EBAY), Apple (AAPL), and Amazon (AMZN).

I doubt that Finisar’s products position it to achieve anywhere near the growth and profitability achieved by the paradigm-shifting businesses led by EBAY, AAPL and AMZN.

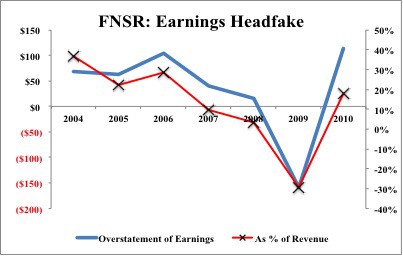

On the other hand, I am sure that Finisar’s business model is worse than what meets the eyes of investors who look only at reported accounting results. Figure 1 plots the difference between reported GAAP earnings and the company’s economic earnings from 2000 to 2010. In 2010, the level of earnings overstatement made a large turn for the worse as reported earnings rose strongly while economic earnings dropped.

Figure 1: 2010 Improvement in FNSR’s Earnings Is Misleading

Sources: New Constructs, LLC and company filings

Sources: New Constructs, LLC and company filings

The large divergence between reported and economic earnings is made possible by (1) the nearly $150 million in additional financing that bloats FNSR’s balance sheet took in 2010 and (2) an accounting loophole that allows the highly-acquisitive Finisar to sweep its capital allocation mistakes under the accounting rug.

Specifically, I refer to the nearly $950 million of assets, after-tax, that the company has written off since 2000.

To put this in perspective, $950 million equals 150% and 250% of the total assets of the company in 2010 and 2009. This means that FNSR’s management has written off $1.50 of assets for every dollar of assets on its 2010 books. And before the issuance of an additional $130 million of equity in 2010, FNSR’s management was writing assets off at a rate closer to $2.50 for every dollar on the balance sheet.

No wonder the company needed more equity capital.

Per our detailed report on asset-write downs, “Given managers are paid to create value, not destroy it, asset write-downs reflect management incompetence and failure to allocate capital effectively.”

The takeaway is obvious: Finisar’s earnings have a higher probability of continuing to come in lower than expected as management’s inability to create value (or proclivity for destroying value) is exposed.

Together, FNSR’s earnings risk and high valuation earn the stock our “very dangerous” rating, which means the stock’s downside risk dwarfs its upside potential.

And for a sense of how much downside risk I see in FNSR: my model shows that with no future profit growth, FNSR is worth about $3.33. Actual results will probably come in somewhere between no future profit growth and current expectations (30% growth for 10 years compounded annually).

My expectation is that future profit growth will come in closer to the “no growth” scenario, which means the stock has a long way to fall before it hits bottom.

We recommend investors short or sell FNSR and any ETFs that allocate to it. As detailed in in Good, Bad and Ugly Tech Sector ETFs, investors must beware the holdings of tech sector ETfs before buying them. Those ETFs have very different holdings and allocations, which results in very different investment potential for each ETF. Below is a list of ETFs we recommend selling because of their “dangerous” ratings and exposure to FNSR.

- SPDR S&P Telecom (XTL) – “dangerous” rating with 2% allocated to FNSR

- iShares Morningstar Small Growth Index (JKK) – “dangerous” rating with 1% allocated to FNSR

For more information on our coverage of sector ETFs, click here.

For a free copy of our report on Finisar, click here.

Disclosures: My fund currently has a short position in Finisar (FNSR) .

.

Note: Stock pick of the week is updated every Tuesday.

3 replies to "More Downside Than Meets The Eye for Finisar"

[…] a free copy of our report on Finisar, click here. Disclosures: My fund currently has a short position in Finisar (FNSR). […]

Have you any concern that as Finisar operates in China, that its operations are modified by the government to enhance its PPS appearence?

Anything that operates in China deserves extra attention. I do not know anything special about FNSR’s China operations, but given their general accounting practices – I would be concerned.