We published an update on this Long Idea on May 19, 2021. A copy of the associated Earnings Update report is here.

If you are looking for a good, safe stock in this volatile market, Wal-Mart is one of the best.

After strong gains in the 1980s and 1990s, Wal-Mart’s stock price is lower now than it was in October 1999.

The stock has gone nowhere in the last decade while revenues have grown 9% compounded annually and after-tax cash flow (NOPAT) has grown 10% compounded annually since 2000.

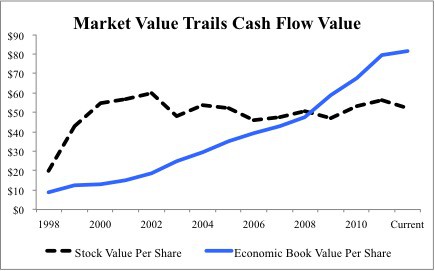

Coming into the last decade, Wal-Mart’s business needed to grow into its stock price. Figure 1 shows how, until 2009, Wal-Mart’s stock price was well above its economic book value, which equals the value of Wal-Mart’s existing cash flows. The basic formula (more details here, on page 5) for economic book value is NOPAT divided by the firm’s weighted average cost of capital (WACC).

I think of the economic book value as the no-growth value of the business or the value of the business if existing profits stay flat forever. WMT’s economic book value is $82 per share today. It’s current stock price of ~$52 per share implies a permanent 35% decline in the company’s profits.

Figure 1: Stock Trades At Steep Discount to Economic Book Value

Sources: New Constructs, LLC and company filings

Sources: New Constructs, LLC and company filings

For most of the first decade of this century, I considered Wal-Mart a good company, but not a good stock. Not anymore.

Now that the stock trades at a 35% discount to its no-growth value, WMT is both a good company and a good stock.

Even if Wal-Mart may be approaching its maximum size, I think the worst-case scenario is that WMT’s profits plateau, which, per above, implies a stock price of $82/share.

I believe profits will not drop off a cliff as the market suggests because Wal-Mart’s management has proven to be excellent capital allocators. Indeed, over the years, there has been little doubt about the quality of Wal-Mart management or the efficiency of its operations.

Lately, growth concerns have weighed on the stock. As Wal-Mart’s growth decelerated, it became a less popular stock in a market that all-too-often seems obsessed with growth at all costs.

The momentum investors that seem to dominate the market these days do not appreciate or understand the value in Wal-Mart’s business now that it is no longer a “growth story”. In their obsession with growth, these investors tend to overhype stocks on the upside and overkill on the downside with little regard to the underlying economics of businesses.

They miss the fact that Wal-Mart generates huge profits with relatively little growth because of its large size.

They also miss the fact that Wal-Mart’s business has been a remarkably steady performer in turbulent times that have derailed many lesser companies.

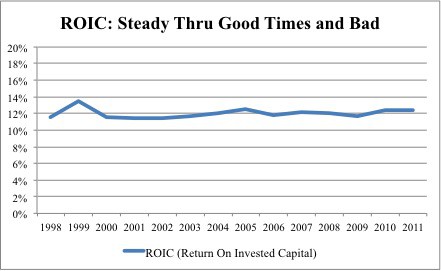

Even while growing NOPAT at 10% per year, Wal-Mart’s return on invested capital (ROIC) has remained admirably steady. See Figure 2. Most companies that grow as much and as steadily suffer steep declines in ROIC as they deploy large amounts of capital with only hopes of future profits.

Not Wal-Mart, its ROIC has held steady as management has intelligently invested in stores, businesses and acquisitions that have earned impressive returns. This achievement puts Wal-Mart in rare company.

Over the past 5 years, Wal-Mart has had the second-least volatile ROIC of all Russell 3000 companies with returns greater than 10%, next to little-known National Bankshares (NKSH), which gets our “attractive” rating.

Figure 2: A Drop In Profits Would Be a Major Aberration

Sources: New Constructs, LLC and company filings

Sources: New Constructs, LLC and company filings

As is often the case in equity markets, stocks overshoot to the upside and to the downside. WMT is an excellent example of a stock whose valuation had overshot to the upside when sentiment was positive. Now, it is an example of a stock that has overshot to the downside as sentiment has turned decidedly negative. You know the script: the more exuberant the positive sentiment, the more ruthless the negative sentiment.

This excess negative sentiment provides investors an excellent opportunity to buy a great business at a great price.

Though WMT’s growth is decelerating and may decline, it is not likely that the company will incur a permanent 35% reduction in profits as implied by the market’s current valuation of the stock. Accordingly, downside risk to the stock is low.

Upside reward potential is strong as the stock has to go over $82/share to trade at a value that implies the company’s profits will experience a 0% decline, a no-growth scenario. If the company does anything better than a 35% decline in profits, the stock has upside.

I also recommend the following ETFs because of their “attractive” rating and exposure to WMT.

- Consumer Staples Select Sector SPDR (XLP)

- Vanguard Consumer Staples ETF – DNQ (VDC)

- Focus Morningstar Consumer Defensive Index ETF (FCD)

- PowerShares Buyback Achievers (PKW)

For more details on WMT’s ROIC and its “very attractive” rating, see our free report on WMT.

Disclosure: I have a position in WMT. I receive no compensation to write about any specific stock, sector or theme.

1 Response to "Blue-Light Special: Wal-Mart Stock"

I’m a believer in your methodology David, but you neglect to factor in, if it even could be, the effect of the Federal Reserve’s EXTRAORDINARY Quantitative Easing policy on the stock price of Walmart during the years referred to in your write-up.

Steve