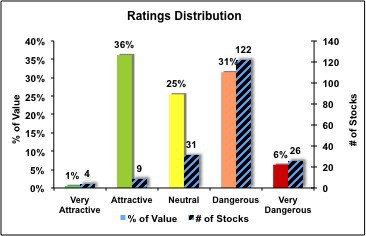

Buy Clorox: Management Focused On Shareholder Value

I take great pleasure in recommending investors buy Clorox (CLX) – an attractive-rated stock, not just because of its strong profitability and cheap valuation but also because of the unusually high quality and integrity of its financial reporting.

David Trainer, Founder & CEO