This post outlines my view of the landscape of investors that populate the market. It is Part 1 in a 3-part series of posts. Part 2 is The End of the Speculative Movement. Part 3 is How To Be Successful Post the Speculative Movement

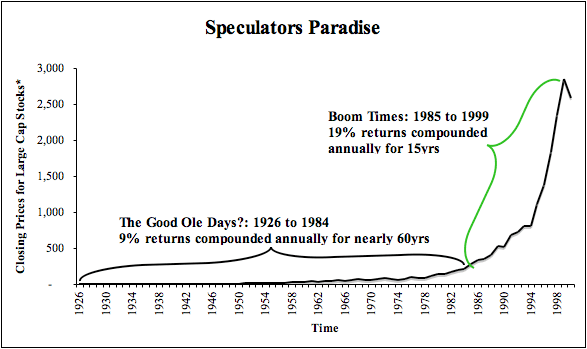

Since the early 1990s, we have seen huge growth in the number of speculators (as defined in : “Investing vs Speculating”) and their impact on the market. Remember how popular “day-trading” became in the late 1990s? Belief that it was easy to make money in the stock market was the primary driver of this boom in speculation. As shown in Exhibit 1, it was fairly easy to make money in the equity markets from 1986 to 1999.

Exhibit 1: Charting Large Cap Stocks* from 1926 to 2000

Source: New Constructs, LLC and Ibbotson[2]

Source: New Constructs, LLC and Ibbotson[2]

* “Large Cap Stocks” as defined by Ibbotson[3] are the best comparison for the S&P 500, which did not exist in 1926 as it does today.

The booming stock market spawned the creation of many “speculative” strategies. These strategies were not at all based on understanding the profitability and valuation of companies; they simply relied on the market going up. As these strategies met with success, they attracted more and more speculators, and increased media attention – creating a self-fulfilling cycle that resulted in two stock market bubbles within 10 years. The size and success of the Speculative Movement has not only created massive Wall Street bonuses. Entire industries have sprouted since the early 1990s to take advantage of speculators and amateur investors. For example, I believe firms like E*Trade thrive by enabling and exploiting speculative investing. Have you noticed the E*Trade commercials showing a baby or a dog using their software to trade stocks? The idea that, by using E*Trade’s software in their spare time, the average person (or a baby or a dog) can out-perform professionals who spend millions of dollars on research and work 60-hour weeks is, in my opinion, a bit of a stretch. In essence, this PR strategy seems aimed to convince people that trading decisions are simplistic, and made stress-free and effortless by using their services. It is as if they are saying: “There is no need for rigorous analysis or discipline: if a child (or a dog) can do it, so can you.” And in many ways, they may be right, or “were” right, at least from 1985 to 1999. As shown in Exhibit 1, the returns of “Large Cap Stocks[1]” from 1985 to 1999 are significantly greater at 19% (compounded annually) than the prior 59 years (1926 to 1984) at 9% (compounded annually). I think it is fair to say that the market has been a bit more exciting (i.e. profitable) in recent times. With a market rising as steeply and quickly as it did from 1985 to 1999, it was, in my opinion, hard not to make money in the equity markets. The phrase, “a rising tide lifts all ships,” comes to mind when I look at Exhibit 1. No wonder so many people flocked to the equity markets; it offered one of the best get-rich-quick opportunities since the gold rush.

The equity markets have become so popular that the media is cashing in as well. Shoot, if a “baby can do it” then, certainly, “a former big-time, Wall-Street trader can help you do it, too”. Allow me to present “Mad Money”, the TV show starring Jim Cramer, a man who admitted that he has manipulated markets by spreading false rumors[4]. There is a disclaimer shown at the beginning and end of that show. It says that the producers and others involved in creating “Mad Money” are allowed to trade on the stocks they know that Cramer is going to talk about before the show is broadcast. This show resembles a pyramid scheme to which viewers knowingly subject themselves. The Speculative Movement was not confined to amateur investors. An alarmingly large number of professional investors joined in. As reported by Wharton professor Brian Bushee in his survey[5] of Institutional Investors: 61% of professional investors consider themselves closet indexers and 31% claim to be pure traders, while only 8% claim to be dedicated, value investors. In my opinion, over 90% of hedge funds still in existence are not “hedged” at all. They more closely resemble casinos offering multiple methods of gambling to their clients. By and large, these gambling methods, in my opinion, boil down to speculating on the near-term direction of stock price movements, while paying little or no attention to the underlying profitability or valuation of companies. But, why not speculate when it proves a successful strategy for nearly 25 years? Plus, given the compensation structure of most hedge funds, one or two years of good returns on a significant amount of money would make managers rich for life. As the market raced upward over most of the last 25 years, the gamble on speculative strategies paid off handsomely and lured more and more investors into the Speculative Movement.

[1] Ibbotson, 2008 Ibbotson Stocks, Bonds, Bills and Inflation Valuation Yearbook, (Chicago: Morning Star, 2008), 228-229. This book is also the source of the returns data, which goes back to 1926. I have not found a source for equit market data going back before 1926.

[2] Ibbotson, 2008 Ibbotson Stocks, Bonds, Bills and Inflation Valuation Yearbook, (Chicago: Morning Star, 2008), 228-229

[3] Id

[4] Jim Cramer reveals how he purposefully uses the media to manipulate markets: http://www.youtube.com/watch?v=vfWSRuNm6do. This video highlights Cramer’s poor track record: http://www.youtube.com/watch?v=SGkrNJ19DSU.

[5] Source: Brian Bushee, “Identifying and Attracting the ‘Right’ Investors: Evidence on the Behavior of Institutional Investors,” Journal of Applied Corporate Finance, Vol. 16, 4, Fall 2004, 28-35.

2 replies to "Market Outlook Part 1: Rise of the Speculative Movement"

[…] Hidden Gems and Red Flags in the Stock Market a blog dedicated to helping investors identify the Most Attractive and Dangerous Investment Opportunities Blog HomeNew ConstructsAbout « Market Outlook Part 1: Rise of the Speculative Movement […]

[…] Market Outlook Part 1: Rise of the Speculative Movement […]