Consumer Staples is one of my top-ranked sectors. As detailed here, only it and the Information Technology sector get my Attractive rating. Sector ratings, like fund ratings, are based on aggregation of my ratings for each of the stocks. All other sectors are rated Neutral or Dangerous. The full series of my reports on the Best & Worst Sector and Style Funds is here.

One good thing about consumer staples stocks is that people have to have the things they sell. Consequently, they can be excellent defensive plays in a time when there is so much uncertainty in the market. No matter how bankrupt Italian, Greeks and Spaniards may be, people still have to eat and buy the sundries required to go about their lives.

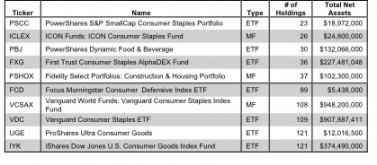

That does not mean that all Consumer Staples funds are good. There is a wide disparity in the quality of funds and stocks within the sector. Investors must tread carefully. There are 19 funds to chose from within the Consumer Staples sector, and they are all very different. Per Figure 1, the number of holdings varies widely (from 23 to 121), which creates drastically different investment implications and ratings. The full list of Consumer Staples funds is here.

How do investors pick the right fund out of the sea of choices that will deliver the best returns?

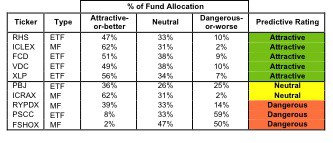

To identify the best funds within a given category, investors need a predictive rating based on analysis of the underlying quality of stocks in each fund. See Figure 2.

Our predictive fund ratings are based on aggregating our stock ratings on each of the fund’s holdings and all of the fund’s expenses. Investors deserve forward-looking fund research that is comparable in quality to stock research.

Investors should not rely on backward-looking research of past performance for investment decisions.

Figure 2 shows the five best and worst-rated funds for the sector. The best funds allocate more value to Attractive-or-better-rated stocks than the worst funds and vice versa, except for ICRAX. This fund gets a Neutral rating despite a sizable allocation to Attractive-or-better-rated stocks because its total annual cost is a whopping 4.4%. My ratings (updated daily) on all funds in this sector are here.

One of my favorite stocks in the Consumer Staples sector is Lorillard [s: LO], which gets my Very Attractive rating. As sad as it may seem to non-smokers, tobacco products remain high on the list of purchase priority list no matter individual’s financial situation. The most profitable products tend to be addictive. If given the choice, few salesmen would turn down the opportunity to sell an addictive versus one that was not addictive. Throw in the fact that cigarettes are relatively cheap to produce and you have an even more compelling value proposition. Nevertheless, the stock is cheap. At $114/share, the valuation of the stock implies the company will never improve its cash flows. Lots of upside to this stock if you believe the company will ever increase profits above current levels.

One of my least favorite Consumer Staples stocks is Kraft [s:KFT], which gets my Dangerous rating. Why do you think the folks at Phillip Morris [s: PM], which gets my Very Attractive rating, sold Kraft off? Perhaps, the price was right, which means the price is too high for public investors. The recent acquisition of Cadbury bloats the company’s balance sheet and lowers the company’s ROIC to near its lowest level of the decade. I think the best days for Kraft are behind it.

Figure 2: Funds with the Best & Worst Ratings – Top 5

* MF designates Mutual Funds and ETF designates Exchange-Traded Funds

* MF designates Mutual Funds and ETF designates Exchange-Traded Funds

* Analysis uses the top-ranked or worst-ranked class for each fund

Sources: New Constructs, LLC and company filings

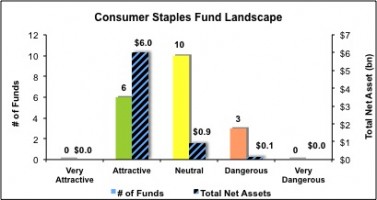

Although over 85% of the value of funds in the Consumer Staples sector is allocated to Attractive-rated funds, it is still easy for investors to miss the mark since this value is allocated to only 6 of the 19 Consumer Staples funds. Figure 3 shows the rating landscape of all ETFs and mutual funds in the Consumer Staples sector.

Our Sector Roadmap report ranks all sectors and highlights those that offer the best investments.

Figure 3: Separating the Best Funds From the Worst

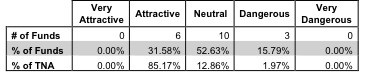

Figure 4 offers additional details on the quality of funds in the sector.

Figure 4: Consumer Staples Fund Landscape Details

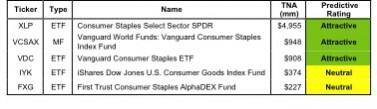

Figure 5 lists our Predictive Fund Rating for the 5 largest and most popular Consumer Staples funds.

Figure 5: Five Largest Consumer Staples Funds

* MF designates Mutual Funds and ETF designates Exchange-Traded Funds

* MF designates Mutual Funds and ETF designates Exchange-Traded Funds

* Analysis uses the top-ranked class for each fund

Sources: New Constructs, LLC and company filings

The full list of Consumer Staples funds and our ratings on each fund is here can be found here.

Disclosure: I own LO. I receive no compensation to write about any specific stock, sector or theme.