The Telecom Services sector ranks ninth out of the ten major sectors as detailed in our sector roadmap. It gets my Dangerous rating, which, like my fund ratings, is based on aggregation of stock ratings for each of 41 companies in the sector. The full series of my reports on the Best & Worst Sector and Style Funds is here.

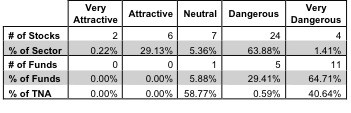

Figure 1 highlights Telecom portfolio managers’ inability to effectively allocate capital. Almost 30% of the Telecom Services sector is made up of Attractive stocks while the sector houses no Attractive funds. 16 of the 17 funds receive my Dangerous-or-worse rating.

Investors should avoid funds in this sector because the cost of portfolio management (active or passive) is not justified. Investors can outperform the funds and avoid the management fees by purchasing the Attractive-or-better rated stocks. The best sectors for finding funds and stocks are Technology and Consumer Staples. My series of Best & Worst Sector Funds reports on all sectors is here.

Figure 1: Telecom Services Sector Landscape For Funds & Stocks

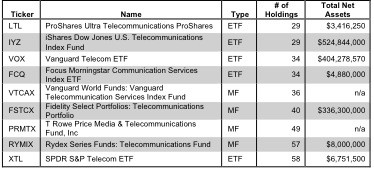

If you must choose a fund in the Telecom Services sector, know that all 17 funds are all very different. Per Figure 2, the number of holding varies widely (from 29 to 58), which creates drastically different investment implications and ratings. Here is the full list of 17 funds.

How do investors pick the right fund out of the sea of choices that will deliver the best returns?

Figure 2: Funds Holdings Count

To identify the best funds within a given category, investors need a predictive rating based on analysis of the underlying quality of stocks in each fund. See Figure 2.

Our predictive fund ratings are based on aggregating our stock ratings on each of the fund’s holdings and all of the fund’s expenses. Investors deserve forward-looking fund research that is comparable in quality to stock research.

Investors should not rely on backward-looking research of past performance for investment decisions.

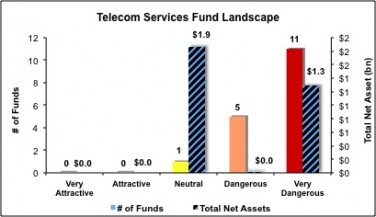

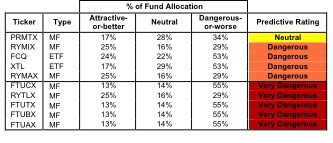

Figure 3 shows the five best and worst-rated funds for the sector. No fund allocates more than 25% of their value to Attractive-or-better-rated stocks. The 5 worst funds earn my Very Dangerous rating because of their poor capital allocation and their high total annual cost. My ratings (updated daily) on all funds in this sector are here.

One of my least favorite Consumer Staples stocks is AT&T [s: T], which gets my Dangerous rating. This company has a long history of misleading earnings and capital misallocation and has gone to rare extremes to window dress their reported earnings. As noted on page 5 of this report, management spent “about $500 million” to record its 1991 acquisition of NCR under the now defunct pooling method of accounting instead of the purchase method. Before FASB finally disallowed the pooling method, the company exploited the loophole and hid about $68 billion in unrecorded goodwill from its balance sheet. In addition, the company’s hidden liabilities are quite large: $17.9 billion of off-balance sheet debt, $22 billion in deferred tax liabilities and $32.5 billion in underfunded pension and post-retirement liabilities. Combined, these liabilities equal over 40% of the company’s current market value. With these key facts in mind, it is hard to justify owning AT&T’s stock. Not surprisingly, the fund that allocates the most (23%) to T, Vanguard Telecommunication Services Index Fund [s: VTCAX], gets my Very Dangerous Rating. VTCAX may have low fees, but why pay any fees to own low-quality stocks. The old saying “you get what you pay for” also applies to funds. If you are going to pay any fees, you should get some decent fund management.

One of my favorite stocks in the Telecom sector is Vonage [s: VG], which gets my Very Attractive rating and was added to the Most Attractive Stocks list in January. Unlike AT&T, Vonage is a shareholder value creator, not destroyer. I also think the company does an excellent job at creating value for its customers. The company’s ROIC is a whopping 73% and its economic earnings are higher than its reported earnings, a rare occurrence among the 3000+ stocks we cover. And like stocks on my Most Attractive list, it has a cheap valuation. The current stock price (~$2.53/share) implies the company’s profits will permanently decline by nearly 30%. The no growth value of the business is $3.45/share or 36% above the current stock price. Good risk/reward.

I cannot say the same for the fund that allocates the most to VG, Fidelity Select Portfolios: Fidelity Advisor Telecommunications Fund [s: FTUTX] as it gets my Very Dangerous Rating. Unfortunately, FTUTX allocates only 1.5% of the value of its portfolio to VG while it allocates over 55% to stocks rated Dangerous-or-worse. Making matters worse, the fund’s total annual costs are a whopping 3.12%. Investors deserve far better portfolio management from a fund charging that much.

Figure 3: Funds with the Best & Worst Ratings – Top 5

* MF designates Mutual Funds and ETF designates Exchange-Traded Funds

* MF designates Mutual Funds and ETF designates Exchange-Traded Funds

Sources: New Constructs, LLC and company filings

Investors should avoid Telecom Services funds. None of the 17 funds for the sector allocate enough value to Attractive-or-better-rated stocks to earn an Attractive overall rating. Figure 3 shows the rating landscape of all ETFs and mutual funds in the Telecom Services sector.

Our Sector Roadmap report ranks all sectors and highlights those that offer the best investments.

Figure 4: Separating the Best Funds From the Worst

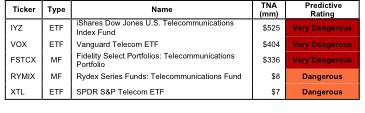

Figure 5 lists our Predictive Fund Rating for the 5 largest and most popular Telecom Services funds.

Figure 5: Five Largest Telecom Services Funds

* MF designates Mutual Funds and ETF designates Exchange-Traded Funds

* MF designates Mutual Funds and ETF designates Exchange-Traded Funds

* Analysis uses the top-ranked class for each fund

Sources: New Constructs, LLC and company filings

The full list of Telecom Services funds and our ratings on each fund is here.

Disclosure: I own VG. I receive no compensation to write about any specific stock, sector or theme.