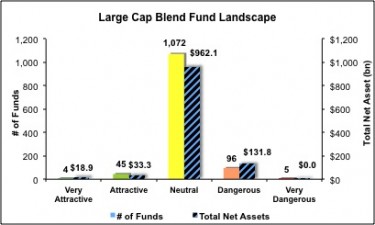

The Large Cap Blend investment style ranks first out of the twelve investment styles as detailed in my style roadmap. It gets my Neutral rating, which is based on aggregation of fund ratings of all 1222 funds in the style. Articles on all style and sector funds are here.

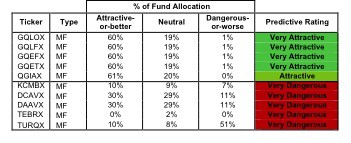

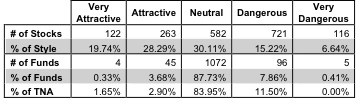

Per Figure 1, 385 out of the 1,804 stocks (nearly 50% of the market cap) held by large cap blend funds get an Attractive-or-better rating. However, only 4 out of 1,222 funds (less than 5% of total net asses) in the style get an Attractive-or-better rating. There are two reasons that funds do not get Attractive-or-better ratings: (1) they do not allocate enough capital to Attractive-or-better stocks, too much to Neutral-or-worse instead and (2) their costs are too high.

As detailed in “Cheap Funds Dupe Investors”, the fund industry offers many cheap funds but very few funds with high-quality stocks, or what I call good portfolio management. Over 95% of all style funds do not justify their costs and overcharge investors.

Investors cannot assume that cheap funds are good investments. Research on the underlying holdings of a fund is necessary for an informed decision.

Figure 1: Large Cap Blend Style Landscape For Funds & Stocks

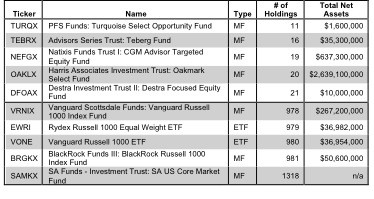

There are 1222 funds to chose from within the Large Cap Blend style, and they are all very different. Per Figure 2, the number of holding varies widely (from 11 to 1318), which creates drastically different investment implications and ratings. Here is the full list of 1222 funds.

How do investors pick the right fund out of the sea of choices that will deliver the best returns?

Figure 2: Funds with Most & Least Holdings – Top 5

To identify the best funds within a given category, investors need a predictive rating based on analysis of the underlying quality of stocks in each fund. See Figure 2.

Our predictive fund ratings are based on aggregating our stock ratings on each of the fund’s holdings and all of the fund’s expenses. Investors deserve forward-looking fund research that is comparable in quality to stock research.

Investors should not rely on backward-looking research of past performance for investment decisions.

Figure 3 shows the five best and worst-rated funds for the style. The 4 best funds earn our Very Attractive rating by holding quality stocks and charging low total annual costs. On the other hand, the five worst over charge investors for poor portfolio management. My ratings (updated daily) on all funds in this style are here.

One of my favorite stocks held by a Large Cap Blend fund is Apple [s: AAPL], which gets my Very Attractive rating. Most people consider AAPL a growth stock, but I see it as a value stock. The underlying economic earnings power of AAPL dwarfs its accounting earnings. With its ROIC at a whopping 270%, AAPL needs very little growth to generate loads of cash, which is why it has nearly $80 billion in excess cash. The stock is cheap as it implies the company will not grow its profits (NOPAT) more than 8% over its remaining life. I think it is a safe bet that AAPL has a little more growth left in it than 8%.

One of my least favorite stocks held by a Large Cap Blend fund is General Electric [s: GE], which gets my Dangerous rating. The company reported misleading earnings in 2010, which means they showed positive and rising accounting earnings while economic earnings are negative and declining. Jack Welch used to brag about how he was able to leverage accounting loopholes to always beat estimate by a penny, and I think the culture of managing superficial accounting results instead of the cash economics of the business persists. Accordingly, I am not comfortable with a valuation that implies the company will grow its profits at over 6% compounded annually for 35 years. 6% (organic) growth is a big number for a company as large as GE. Growth over the last 5 years is negative. This stock is not a good bet now.

Figure 3: Funds with the Best & Worst Ratings – Top 5

* MF designates Mutual Funds and ETF designates Exchange-Traded Funds

* MF designates Mutual Funds and ETF designates Exchange-Traded Funds

Sources: New Constructs, LLC and company filings

Investors need to tread carefully when considering Large Cap Blend funds, as 96% of funds are not worth buying. Only 49 of the 1222 funds allocate enough value to Attractive-or-better-rated stocks to earn an Attractive-or-better rating. Figure 3 shows the rating landscape of all ETFs and mutual funds in the Large Cap Blend style.

Our style roadmap report ranks all styles and highlights those that offer the best investments.

Figure 4: Separating the Best Funds From the Worst

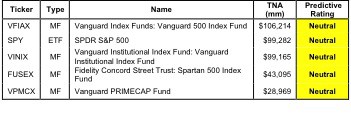

Figure 5 lists our Predictive Fund Rating for the 5 largest and most popular Large Cap Blend funds.

Figure 5: Five Largest Large Cap Blend Funds

* MF designates Mutual Funds and ETF designates Exchange-Traded Funds

* MF designates Mutual Funds and ETF designates Exchange-Traded Funds

* Analysis uses the top-ranked class for each fund

Sources: New Constructs, LLC and company filings

The full list of Large Cap Blend funds and our ratings on each fund is here.

Disclosure: I own AAPL. I receive no compensation to write about any specific stock, sector or theme.

4 replies to "Best and Worst Funds: Large Cap Blend Style"

All of the top rated funds have very high minimum investments. Are there any attractive funds, in your opinion, that have minimum investments better suited to the average investor?

Michael:

Pls take a look at the search results from this link: http://bit.ly/yU5rJh

It shows one 5 star fund and several 4-star funds with a $0 minimum.

To create that search, I first searched the whole universe of mutual funds and stripped out ETFs. Then I ordered the results by “Minimum Investment”.

You can strip out ETFs from results by unchecking the “ETF” box.

You can order the results on the page by clicking on any of the column headers.

Thanks. I found the fund search after I posted. I appreciate your work and time spent.

Thanks! Really great material!