The large cap growth investment style ranks third out of the twelve investment styles as detailed in my style roadmap. It gets my Neutral rating, which is based on aggregation of fund ratings of all 771 funds in the style. Articles on all style and sector funds are here.

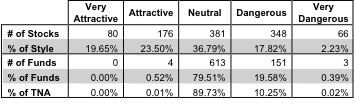

Figure 1 shows the alarming fact that over 99% of all large cap growth funds are not worth buying because they get my Neutral-or-worse rating. Digging deeper into the 1,051 stocks held by all large cap growth funds reveals that 75% of those stocks (57% of the value) earn my Neutral-or-worse rating. The takeaway is that fund managers are allocating too much capital to low-quality stocks.

Investors seeking exposure to large cap growth stocks should purchase a basket of Attractive-or-better rated stocks and avoid paying fund managers fees they do not deserve.

As detailed in “Cheap Funds Dupe Investors”, the fund industry offers many cheap funds but very few funds with high-quality stocks, or with what I call good portfolio management. Over 95% of all style funds get low portfolio management ratings and do not justify their costs.

Figure 1: Large Cap Growth Style Landscape For Funds & Stocks

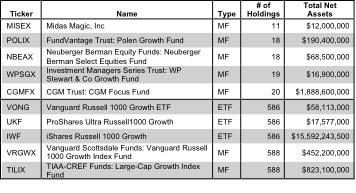

The 771 large cap growth funds are all very different. Per Figure 2, the number of holding varies widely (from 11 to 588), which creates drastically different investment implications and ratings. Review my full list of ratings and free reports on all 771 funds.

How do investors pick the right fund out of the sea of choices that will deliver the best returns?

Figure 2: Funds with Most & Least Holdings – Top 5

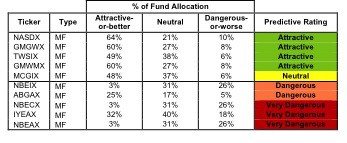

To identify the best funds within a given category, investors need a predictive rating based on analysis of the underlying quality of stocks in each fund. See Figure 3.

My predictive fund ratings are based on aggregating our stock ratings on each of the fund’s holdings and all of the fund’s expenses. Investors should not rely on backward-looking research of past performance for investment decisions.

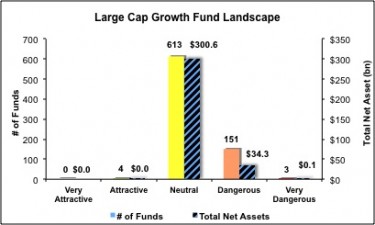

Figure 3 shows the five best and worst-rated funds for the style. The four Attractive funds hold quality stocks, i.e. get an Attractive portfolio management rating, and have low total annual costs while the three Very Dangerous funds charge investors for poor portfolio management. My ratings and reports (updated daily) on all funds in this style are here.

Figure 3: Funds with the Best & Worst Ratings – Top 5

* MF designates Mutual Funds and ETF designates Exchange-Traded Funds

* MF designates Mutual Funds and ETF designates Exchange-Traded Funds

Sources: New Constructs, LLC and company filings

My top-rated large cap growth fund is Shelton Funds: Nasdaq-100 Index Fund [s: NASDX], which gets my Attractive rating. One of its largest holdings and part of the 64% it allocates to Attractive-or-better stocks is Oracle [s: ORCL], which gets my Very Attractive rating. I am bullish on the tech sector and ORCL is one of the best stocks in that sector. Like my other favorites stocks in the sector, ORCL boasts a top-quintile ROIC (28%). Despite its disappointing 3Q11 earnings, the company maintains a very strong competitive position. Adept leadership has never been a problem as the company’s ROIC has stayed well above its cost of capital since at least 1998. With over $28 billion (about 20% of its market cap) in excess cash, Larry Ellison has the dry powder he needs to remain a leader in the software business.

But that is not what the stock market thinks. The current valuation of the stock (~$29/share) implies the company’s after-tax cash flow will grow no more than 8% over its remaining corporate life. I think the market is underestimating Mr. Ellison and his management team.

My worst-rated large cap growth fund is Neuberger Berman Equity Funds: Neuberger Berman Select Equities Fund [s: NBEAX]. One of its largest holdings and part of the 26% it allocates to Dangerous-or-worse stocks is El Paso Corp [s: EP], which gets my Very Dangerous rating.

El Paso is a classic value destroyer despite showing positive and rising accounting earnings. EP’s management has done a good jog of hiding its value-destroying track record in the footnotes to its financial statements. Reviewing the company’s financial fine print reveals that management allocated nearly $16 billion (equal to ~70% of the company’s net assets) to unrecorded goodwill by employing the now-defunct accounting loophole called the pooling method of accounting for acquisitions. In addition, since 1998, management has written off $6.7 billion in assets (after-tax), equal to ~30% of net assets. This suggests that management loses 30 cents on every dollar of equity in the business. Putting these hidden value back on EP’s balance sheet reduces its already low ROIC of 6% to 3%. Not so good.

The market’s valuation of the stock suggests that investors may not be aware of the unrecorded goodwill or history of write-downs at EP. The current stock price (~$27) implies the company will grow its after-tax cash flow (NOPAT) at 15% compounded annually for almost 10 years. Clearing that hurdle would require not only a major turnaround of the profitability of the business but also sustained growth at levels far higher than anything the company has achieved in recent history.

Investors need to tread carefully when considering large cap growth funds, as 99% of funds are not worth buying. Only 4 of the 771 funds for the style allocate enough value to Attractive-or-better-rated stocks to earn an Attractive rating. Figure 3 shows the rating landscape of all ETFs and mutual funds in the Large Cap Growth style.

Our style roadmap report ranks all styles and highlights those that offer the best investments.

Figure 4: Separating the Best Funds From the Worst

Figure 5 lists our Predictive Fund Rating for the 5 largest and most popular Large Cap Growth funds.

Figure 5: Five Largest Large Cap Growth Funds

* MF designates Mutual Funds and ETF designates Exchange-Traded Funds

* MF designates Mutual Funds and ETF designates Exchange-Traded Funds

* Analysis uses the top-ranked class for each fund

Sources: New Constructs, LLC and company filings

Review my full list of ratings and rankings along with free reports on all 771 large cap growth funds.

Disclosure: I own ORCL. I receive no compensation to write about any specific stock, sector or theme.