The large cap value investment style ranks fourth out of the twelve investment styles as detailed in my style roadmap. It gets my Neutral rating, which is based on aggregation of fund ratings of all 821 funds in the style. Articles on all style and sector funds are here.

For too long investors have selected funds based on costs rather than quality.

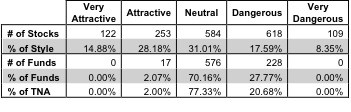

Figure 1 highlights investors’ inability to buy funds with quality holdings by showing that 98% of assets in large cap value funds goes to funds with a Neutral-or-worse rating. Investors are not entirely to blame for this misallocation of capital as the fund industry is not giving them many good choices.

Though 375 out of the 1,686 stocks (43% of the market cap) held by large cap value funds get an Attractive-or-better rating, only 17 out of 821 (2% of total) large cap value funds get an Attractive-or-better rating. The takeaway is that fund managers are allocating too much capital to low-quality stocks.

Investors seeking exposure to large cap value stocks should purchase a basket of Attractive-or-better rated stocks and avoid paying fund managers fees they do not deserve.

Figure 1: Large Cap Value Style Landscape For Funds & Stocks

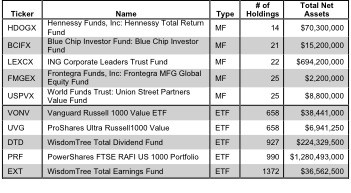

The 821 large cap value funds are all very different . Per Figure 2, the number of holding varies widely (from 14 to 1372), which creates drastically different investment implications and ratings. Review my full list of ratings along with free reports on all 821 funds.

How do investors pick the right fund out of the sea of choices that will deliver the best returns?

Figure 2: Funds with Most & Least Holdings – Top 5

To identify the best funds within a given category, investors need a predictive rating based on analysis of the underlying quality of stocks in each fund. See Figure 3.

My predictive fund ratings are based on aggregating our stock ratings on each of the fund’s holdings and all of the fund’s expenses. Investors should not rely on backward-looking research of past performance for investment decisions.

Figure 3 shows the five best and worst-rated funds for the style. The worst funds allocate a substantial amount of value to poor quality holdings (Dangerous-or-worse-rated stocks) and have high total annual cost. My ratings and reports (updated daily) on all funds in this style are here.

Figure 3: Funds with the Best & Worst Ratings – Top 5

* MF designates Mutual Funds and ETF designates Exchange-Traded Funds

* MF designates Mutual Funds and ETF designates Exchange-Traded Funds

Sources: New Constructs, LLC and company filings

My top-rated large cap value fund is Sterling Capital Funds: Sterling Capital Equity Income Fund [s: BEGIX], which gets my Attractive rating. One of its largest holdings and part of the 41% it allocates to Attractive-or-better stocks is Baxter International [s: BAX], which gets my Very Attractive rating. I am bullish on the health care sector and BAX is one of the best stocks in that sector. The company earns a top-quintile ROIC of 15% on over $16 billion of invested capital. Not once since 1998, which is far back as my model goes, has the company’s ROIC been below its cost of capital. During the same period, the company’s economic earnings have improved from $45 million to over $1.4 billion, a 3000% increase.

The current stock price is betting against the company’s value creation track record. At ~$57/share, the current valuation of the stock implies the company’s after-tax cash flow (NOPAT) will permanently decline by 9%. Assuming no future profit growth, this stock is worth over $62. Very attractive risk/reward here.

My worst-rated large cap value fund is Ivy Funds: Ivy Value Fund [s: IYVBX], which gets my Dangerous rating. One of its largest holdings and part of the 24% it allocates Dangerous-or-worse stocks is Wells Fargo [s: WFC], which gets my Very Dangerous rating. I am bearish on the Financial sector and WFC is one of the worst stocks in that sector. As detailed in prior articles, the big banks are not above monkeying with their accounting to ensure they meet earnings expectations even if it means sacrificing cash flows. For 2010, WFC reported positive and rising accounting earnings while economic earnings were negative and declining. I will not know if that trend continues for 2011 until the company releases its 2011 10-K, the only place you will find a complete version of the Notes to the Financial Statements. Until I analyze the footnotes, I will not know if WFC bled its loan loss reserves to boost earnings by $1.5 billion as it did last year or added to its $6.3 billion in off-balance sheet debt from last year. Without reading the footnotes, investors cannot gain a clear picture of the financials of a company. And when I do that for WFC, the picture is not pretty.

In contrast, the current valuation of the stock forecasts a beautiful outlook for the company’s cash flow. At ~$30.50/share, the stock price implies the company will grow its profits at 13% compounded annually for 10 years. That is a high hurdle for management to clear especially considering their track record and the unfriendly regulatory environment they face.

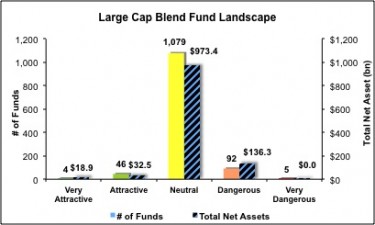

Investors need to tread carefully when considering large cap value funds, as 98% are not worth buying. Only 17 of the 821 funds allocate enough value to Attractive-or-better-rated stocks to earn an Attractive rating. Figure 4 shows the rating landscape of all large cap value ETFs and mutual funds.

Our style roadmap report ranks all styles and highlights those that offer the best investments.

Figure 4: Separating the Best Funds From the Worst

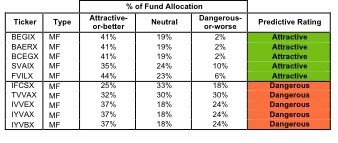

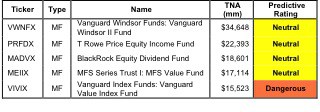

Figure 5 lists our Predictive Fund Rating for the 5 largest and most popular large cap value funds.

Figure 5: Five Largest Large Cap Value Funds

* MF designates Mutual Funds and ETF designates Exchange-Traded Funds

* MF designates Mutual Funds and ETF designates Exchange-Traded Funds

* Analysis uses the top-ranked class for each fund

Sources: New Constructs, LLC and company filings

Review my full list of ratings and rankings along with free reports on all 821 large cap value funds.

Disclosure: I receive no compensation to write about any specific stock, sector or theme.