The mid-cap growth style ranks seventh out of the twelve fund styles as detailed in my style roadmap. It gets my Dangerous rating, which is based on aggregation of fund ratings of 396 mid-cap growth funds as of February 9, 2012. Articles on all style and sector funds are here.

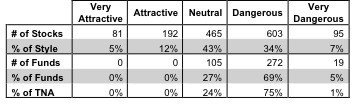

Figure 1 shows the alarming truth that no mid-cap growth funds are worthy of investment. All 396 earn a Neutral-or-worse rating. Digging into the quality of the funds’ holdings shows that 1163 out of the 1436 stocks (over 83% of the market cap) held by mid-cap growth funds get my Neutral-or-worse rating. The takeaway is: fund managers allocate too much capital to low-quality stocks.

Investors seeking exposure to mid-cap growth stocks should buy a basket of Attractive-or-better rated stocks and avoid paying undeserved fund fees.

As detailed in “Cheap Funds Dupe Investors”, the fund industry offers many cheap funds but very few funds with high-quality stocks, or with what I call good portfolio management.

Figure 1: Mid-cap Growth Style Landscape For Funds & Stocks

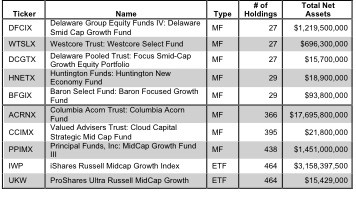

The 396 mid-cap growth funds are very different. Per Figure 2, the number of holding varies widely (from 27 to 464), which creates drastically different investment implications and ratings. Review my full list of ratings along with free reports on all 396 mid-cap growth funds.

How do investors pick the fund that will most likely deliver the best future returns?

Figure 2: Funds with Most & Least Holdings – Top 5

To identify the best funds within a given category, investors need a predictive rating based on analysis of the underlying quality of stocks in each fund. See Figure 3.

My predictive fund ratings are based on aggregating (1) my stock ratings on each of the fund’s holdings and (2) all of the fund’s expenses. Investors should not rely on backward-looking research.

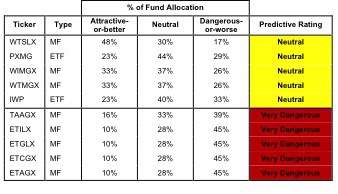

Figure 3 shows the five best and worst-rated funds for the style. The best funds allocate more value to Attractive-or-better-rated stocks than the worst funds and vice versa. The five worst funds offer poor quality holdings and do not justify their extremely high total annual costs, which range from 5.02% to a whopping 8.06%. My ratings and reports (updated daily) on all funds in this style are here.

Figure 3: Funds with the Best & Worst Ratings – Top 5

* MF designates Mutual Funds and ETF designates Exchange-Traded Funds

* MF designates Mutual Funds and ETF designates Exchange-Traded Funds

Sources: New Constructs, LLC and company filings

My top-rated mid-cap growth fund is Westcore Trust: Westcore Select Fund [s: WTSLX], which gets my Neutral predictive rating based on Neutral ratings for both its portfolio management and total annual costs.

One of its largest holdings and part of the 48% of the fund allocated to Attractive-or-better stocks is TJX Companies, Inc. [s: TJX], which gets my Attractive rating. If you are going to be in retail these days, discount retail is the place to be. TJX is very well-positioned to serve a growing population of cost-conscious shoppers who want to get the most for their money. In hard economic times, people have little desire to pay the premiums charged for products at the high-end, fancy stores. It is not practical. On the other hand, knowing that money goes farther at a store like TJ Max makes that store very attractive. One might expect that charging lower prices would results in lower margins for TJX, but that is not true. TJX has a very profitable business with a top-quintile ROIC of 17%. Its 2011 economic earnings grew more than its accounting earnings after removing non-operating charges and taxes from its reported results. Over the past five years, TJX has averaged 25% growth in economic earnings versus just 15% in accounting earnings.

The market is not giving TJX’s stock credit for its economic earnings growth. The current valuation (~$34.57/share) implies about 6.5% economic earnings growth for 5 years. That looks low compared to what the company has done and is positioned to do.

My worst-rated mid-cap growth fund is Mutual Fund Series Trust: Eventide Gilead Fund [s: ETAGX], which gets my Very Dangerous predictive rating based on a Dangerous portfolio management rating and a Very Dangerous total annual costs rating. With total annual costs over 8%, this fund would not get an Attractive-or-better predictive rating no matter how good the portfolio management. That this fund charges so much for poor portfolio management is a travesty.

One of its largest holdings and part of the 45% of the fund allocated to Dangerous-or-worse stocks is Pharmacyclics Inc. [s: PCYC], which gets my Very Dangerous rating. The guys running this fund better be PHDs for investing in a bio-tech stock like PCYC. Nothing about this company’s current financials looks good. Its ROIC is -38%. Its 2011 economic earnings declined by more than its accounting earnings. The financials are worse than they appear on the surface.

The stock’s valuation (~$19.8/share), on the other hand, implies the company’s profits will shoot the moon, i.e. grow its revenues by 100% compounded annually for over 6 years. This company’s drug pipeline would have to perform better than most rational people’s wildest dreams to meet those expectations. The managers of ETAGX are getting paid very well to gamble with investors money. Ouch.

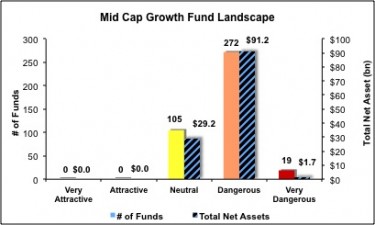

Figure 4 shows the rating landscape of all mid-cap growth ETFs and mutual funds.

Our style roadmap report ranks all styles and highlights those that offer the best investments.

Figure 4: Separating the Best Funds From the Worst Funds

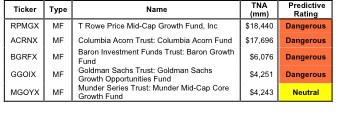

Figure 5 lists our Predictive Fund Rating for the 5 largest and most popular mid-cap growth funds.

Figure 5: Five Largest Mid-cap Growth Funds

* MF designates Mutual Funds and ETF designates Exchange-Traded Funds

* MF designates Mutual Funds and ETF designates Exchange-Traded Funds

* Analysis uses the top-ranked class for each fund

Sources: New Constructs, LLC and company filings

Review my full list of ratings and rankings along with free reports on all 396 mid-cap growth funds.

Disclosure: I receive no compensation to write about any specific stock, sector or theme.