The mid-cap value style ranks tenth out of the twelve fund styles as detailed in my style roadmap. It gets my Dangerous rating, which is based on aggregation of fund ratings of 239 mid-cap value funds as of Feb 14th 2012. Articles on the funds in each sector and style are here.

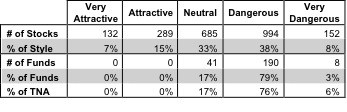

Figure 1 shows that none of the 239 mid-cap value funds are not worth buying. They all get a Neutral-or-worse rating. The majority (198 out of 239) are Dangerous-or-worse. 1831 of the 2252 stocks (over 78% of the market cap) held by mid-cap value funds earn a Neutral-or-worse rating. The takeaway is: fund managers allocate too much capital to low-quality stocks.

Investors seeking exposure to mid-cap value stocks should buy a basket of Attractive-or-better rated stocks and avoid paying undeserved fund fees. Active management has a long history of not paying off.

As detailed in “Cheap Funds Dupe Investors”, the fund industry offers many cheap funds but very few funds with high-quality stocks, or with what I call good portfolio management.

Figure 1: Mid-cap Value Style Landscape For Funds & Stocks

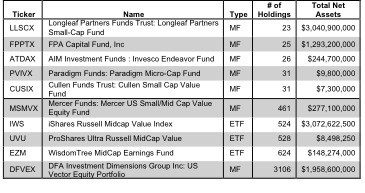

The 239 mid-cap value funds are very different. Per Figure 2, the number of holding varies widely (from 23 to 3106), which creates drastically different investment implications and ratings. Review my full list of ratings along with free reports on all 239 mid-cap value funds.

How do investors pick the fund that will most likely deliver the best future returns?

Figure 2: Funds with Most & Least Holdings – Top 5

To identify the best funds within a given category, investors need a predictive rating based on analysis of the underlying quality of stocks in each fund. See Figure 3.

My predictive fund ratings are based on aggregating (1) my stock ratings on each of the fund’s holdings and (2) all of the fund’s expenses. Investors should not rely on backward-looking research.

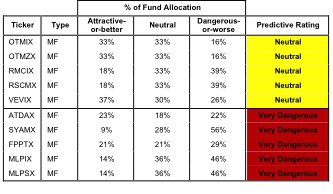

Figure 3 shows the five best and worst-rated funds for the style. The best funds allocate more value to Attractive-or-better-rated stocks than the worst funds and vice versa. The worst funds offer poor portfolio management and charge high total annual costs. My ratings and reports (updated daily) on all funds in this style are here.

Figure 3: Funds with the Best & Worst Ratings – Top 5

* MF designates Mutual Funds and ETF designates Exchange-Traded Funds

* MF designates Mutual Funds and ETF designates Exchange-Traded Funds

Sources: New Constructs, LLC and company filings

My top-rated mid-cap value fund is Old Mutual funds II: Old Mutual TS&W Mid Cap Value Fund [s: OTMIX], which gets my Neutral rating. One of its largest holdings and part of the 33% allocated to Attractive-or-better stocks is Annaly Capital Management, Inc. [s: NLY], which gets my Attractive Rating rating. Overall, I’m bearish on the Financials sector, but NLY is a diamond in the rough.

With a top-quintile ROIC of 15%, NLY’s management is one of very few in the Financial sector to allocate capital effectively. At ~$16.56/share the current stock price implies that the company’s after-tax cash flows (NOPAT) will permanently decrease by 10%. The stock is worth over $29 if the company only manages to keep profits from declining. Any future profit growth means big upside for this stock.

My worst-rated mid-cap value fund is ProFunds: Mid-Cap Value Profund [s: MLPSX], which gets my Very Dangerous rating. One of its largest holdings and part of the 46% allocated to Dangerous-or-worse stocks is Southern Union Company [s: SUG], which gets my Dangerous rating. I’m bearish on the Utility sector and SUG exemplifies the poor profitability and excess valuations in the sector. The company’s ROIC is a disappointing 5% and the company has never, over the 13 years I’ve modeled, earned an ROIC greater than it’s weighted average cost of capital (WACC).

In spite of SUG’s pitiful past performance, the company’s stock price at ~$43.58/share implies that NOPAT will increase by 10% compounded annually for almost 20 years. I think the rate payers (and the regulators) would demand a cut in prices before allowing a utility to be so profitable.

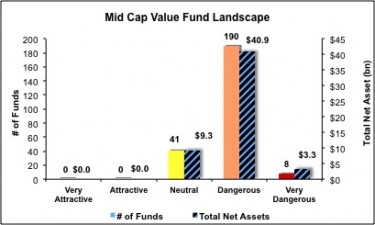

Investors should steer clear of all mid-cap value funds, as none of the 239 funds are not worth buying. Figure 4 shows the rating landscape of all mid-cap value ETFs and mutual funds.

Our style roadmap report ranks all styles and highlights those that offer the best investments.

Figure 4: Separating the Best Funds From the Worst Funds

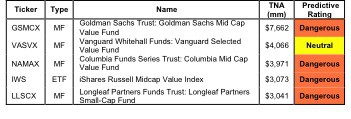

Figure 5 lists our Predictive Fund Rating for the 5 largest and most popular mid-cap value funds.

Figure 5: Five Largest Mid-cap Value Funds

* MF designates Mutual Funds and ETF designates Exchange-Traded Funds

* MF designates Mutual Funds and ETF designates Exchange-Traded Funds

* Analysis uses the top-ranked class for each fund

Sources: New Constructs, LLC and company filings

Review my full list of ratings and rankings along with free reports on all 239 mid-cap value funds.

Disclosure: I receive no compensation to write about any specific stock, sector or theme.