The small-cap growth style ranks ninth out of the twelve fund styles as detailed in my style roadmap. It gets my Dangerous rating, which is based on aggregation of fund ratings of 486 small-cap growth funds as of Feb 13th 2012. Articles on all style and sector funds are here.

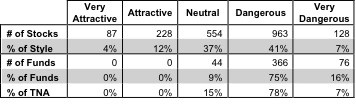

Figure 1 highlights the alarming truth that none of the 486 small-cap growth funds are worth buying. They all get a Neutral-or-worse rating. Digging into the quality of the funds’ holdings shows that 1645 of the 1960 stocks (over 85% of the market cap) held by small-cap growth funds earn a Neutral-or-worse rating. The takeaway is: fund managers allocate too much capital to low-quality stocks.

Investors seeking exposure to small-cap growth stocks should buy a basket of Attractive-or-better rated stocks and avoid paying undeserved fund fees. Active management has a long history of not paying off.

As detailed in “Cheap Funds Dupe Investors”, the fund industry offers many cheap funds but very few funds with high-quality stocks, or with what I call good portfolio management.

Figure 1: Small-cap Growth Style Landscape For Funds & Stocks

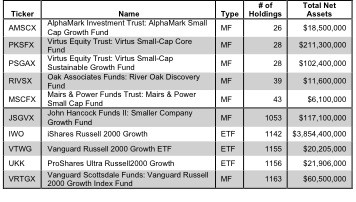

The 486 small-cap growth funds are very different. Per Figure 2, the number of holding varies widely (from 26 to 1163), which creates drastically different investment implications and ratings. Review my full list of ratings along with free reports on all 486 small-cap growth funds.

How do investors pick the fund that will most likely deliver the best future returns?

Figure 2: Funds with Most & Least Holdings – Top 5

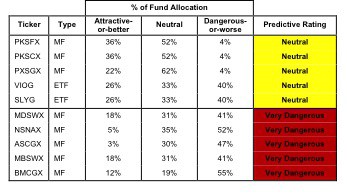

To identify the best funds within a given category, investors need a predictive rating based on analysis of the underlying quality of stocks in each fund. See Figure 3.

My predictive fund ratings are based on aggregating (1) my stock ratings on each of the fund’s holdings and (2) all of the fund’s expenses. Investors should not rely on backward-looking research of past performance.

Figure 3 shows the five best and worst-rated funds for the style. The best funds allocate more value to Attractive-or-better-rated stocks than the worst funds and vice versa. The worst stocks offer poor fund management and charge high total annual costs. For example, Bhirud Funds, Inc: Apex Mid Cap Growth Fund’s [s: BMCGX] charges 10.25%, after accounting for all costs. That is the highest of all 7400+ funds we cover. For perspective, BMCGX must outperform its ETF benchmark by 10.3% annually over any holding period to justify its higher costs. My ratings and reports (updated daily) on all funds in this style are here.

Figure 3: Funds with the Best & Worst Ratings – Top 5

* MF designates Mutual Funds and ETF designates Exchange-Traded Funds

* MF designates Mutual Funds and ETF designates Exchange-Traded Funds

Sources: New Constructs, LLC and company filings

My top-rated small-cap growth fund is Virtus Equity Trust: Virtus Small-Cap Core Fund (PKSFX), which gets my Neutral rating. One of its largest holdings and part of the 36% allocated to Attractive-or-better stocks is Copart Inc. [s: CPRT]. This small-cap stock might not be small much longer. With an ROIC of 17% and economic earnings growing faster than accounting earnings (24% vs 10%) in 2011, this business is generating big-time cash for shareholders. Car auctions are meaningfully more profitable and scalable operations with recent technological advances, and Copart is building a very strong footprint that could enable it to grow faster and for longer than its competitors.

The valuation of the stock assumes the company’s growth will hit a brick wall in two years. At ~$46.47/share, the current valuation implies just two years of after-tax cash flow (NOPAT) growth at 7.5%.

My worst-rated small-cap growth fund is Bhirud Funds, Inc: Apex Mid Cap Growth Fund [s: BMCGX], which gets my Very Dangerous rating. This fund is a double loser. Its holdings get a Dangerous rating and its costs get a Very Dangerous rating. As noted above, BMCGX has the highest all-in costs of any of the 7400+ funds we cover (10.3%). Ouch.

One of its largest holdings and part of the 54% allocated to Dangerous-or-worse stocks is TiVo Inc. [s: TIVO], which gets my Dangerous rating. I have used a Tivo DVR for over a decade, and I love it. However, their business model is in real trouble. Legal expenses incurred to protect their patents are killing the business. I do not think they will be able to prevent other firms from selling perfectly functional DVRs without paying them royalties. The company’s 2011 ROIC is -117%. It is far from turning a profit.

Yet, the valuation of the stock seems oblivious to its unprofitable ways. At ~$12/share, the current valuation implies the company will grow its revenues at 50% compounded annually for 12 years while also increasing its ROIC from -117% to 20%. There are too many other stocks in the market with lower expectations and better businesses to take the risk in owning this stock.

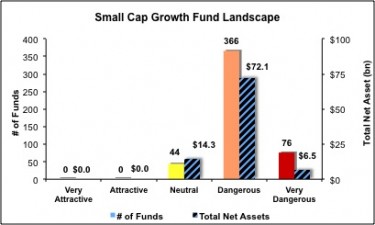

Investors should avoid all small-cap growth funds since all 486 earn a Neutral-or-worse rating and are not worth buying. Figure 4 shows the rating landscape of all small-cap growth ETFs and mutual funds. Our style roadmap report ranks all styles and highlights those that offer the best investments.

Figure 4: Separating the Best Funds From the Worst Funds

Sources: New Constructs, LLC and company filings

Sources: New Constructs, LLC and company filings

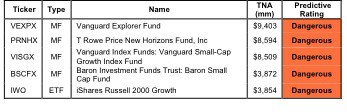

Figure 5 lists our Predictive Fund Rating for the 5 largest and most popular small-cap growth funds.

Figure 5: Five Largest Small-cap Growth Funds

* MF designates Mutual Funds and ETF designates Exchange-Traded Funds

* MF designates Mutual Funds and ETF designates Exchange-Traded Funds

* Analysis uses the top-ranked class for each fund

Sources: New Constructs, LLC and company filings

Review my full list of ratings and rankings along with free reports on all 486 small-cap growth funds.

Disclosure: I receive no compensation to write about any specific stock, sector or theme.