The small-cap value style ranks last out of the twelve fund styles as detailed in my style roadmap. It gets my Dangerous rating, which is based on aggregation of fund ratings of 327 small-cap value funds as of Feb 15th2012. My 25 articles on the Best & Worst Funds in each sector and style are here.

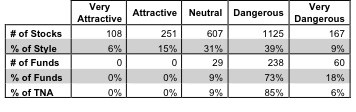

Figure 1 highlights that 91% of small-cap value funds earn a Dangerous-or-worse rating and should be sold. These poor ratings are driven by poor quality holdings. 1899 of the 2258 stocks (over 79% of the market cap) held by small-cap value funds earn a Neutral-or-worse rating. The takeaway is: fund managers allocate too much capital to low-quality stocks.

Investors seeking exposure to small-cap value stocks should buy a basket of Attractive-or-better rated stocks and avoid paying undeserved fund fees. Active management has a long history of not paying off.

As detailed in “Cheap Funds Dupe Investors”, the fund industry offers many cheap funds but very few funds with high-quality stocks, or with what I call good portfolio management.

Figure 1: Small-cap Value Style Landscape For Funds & Stocks

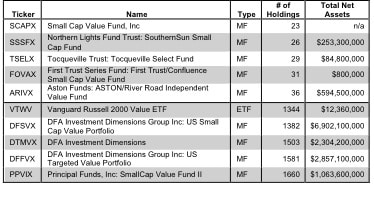

The 327 small-cap value funds are very different. Per Figure 2, the number of holding varies widely (from 23 to 1660), which creates drastically different investment implications and ratings. Review my full list of ratings along with free reports on all 327 small-cap value funds.

How do investors pick the fund that will most likely deliver the best future returns?

Figure 2: Funds with Most & Least Holdings – Top 5

To identify the best funds within a given category, investors need a predictive rating based on analysis of the underlying quality of stocks in each fund. See Figure 3.

My predictive fund ratings are based on aggregating (1) my stock ratings on each of the fund’s holdings and (2) all of the fund’s expenses. Investors should not rely on backward-looking research of past performance.

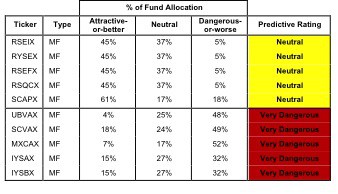

Figure 3 shows the five best and worst-rated funds for the style. The best funds allocate more value to Attractive-or-better-rated stocks than the worst funds and vice versa. The worst funds offer poor portfolio management and charge high total annual costs. My ratings and reports (updated daily) on all funds in this style are here.

Figure 3: Funds with the Best & Worst Ratings – Top 5

* MF designates Mutual Funds and ETF designates Exchange-Traded Funds

* MF designates Mutual Funds and ETF designates Exchange-Traded Funds

Sources: New Constructs, LLC and company filings

My top-rated small-cap value fund is Royce Fund: Royce Special Equity Fund [s: RSEIX], which gets my Neutral rating. One of its largest holdings and part of the 45% allocated to Attractive-or-better stocks is AVX Corporation [s: AVX], which gets my Very Attractive rating.

I’m bullish on the Tech sector and AVX is one of the best stocks in the sector. As a manufacturer of products that store and regulate energy for electronic devices, there will continue to be plenty of demand for AVX products. The company has a positive and rising ROIC over the past 3 years with a 2010 ROIC of 21%, which earns a top-quintile rank. With a strong business model and strong demand, the company is well positioned to continue to grow economic earnings.

But the stock’s valuation suggests the opposite. At ~$13.46/share, the current valuation implies its after-tax cash flows (NOPAT) will permanently decrease by 50%. The no-growth value of the stock is over $28/share. Nice combination of low risk and high potential reward.

My worst-rated small-cap value fund is Ivy Funds: Ivy Small Cap Value Fund [s: IYSBX], which gets my Very Dangerous rating. One of its largest holdings and part of the 32% allocated to Dangerous-or-worse stocks is Triumph Group Inc. [s: TGI], which gets my Very Dangerous rating. Aerospace is not exactly a high-growth industry. Its is dominated by a few large competitors who must constantly wrangle with heavy regulation. I don’t see this changing any time soon unless a moon base becomes reality.

Triumph’s profitability, when you dig beneath the reported accounting results, reflects the challenging nature of the industry. First, my model shows TGI’s accounting earnings are misleading, which means the company reports positive and increasing EPS while its economics earnings are actually negative and decreasing. Investors reliant on the P/E and EPS valuation mindset may view TGI as an attractive company, but I can assure you, they are wrong. The company earns a meager 7% ROIC on its 3.2 billion of invested capital.

To justify its valuation, the stock at $63 implies the company will grow its profits at 10% compounded annually for 15 years. Good luck. The combination of misleading earnings and expensive valuation make this stock very dangerous.

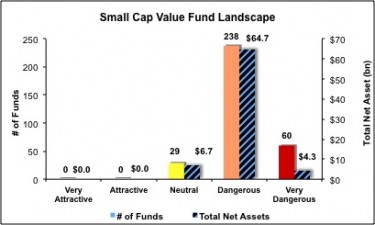

Investors need to avoid all small-cap value funds, as none are not worth buying. In fact, over 91% of the small-cap funds earn a Dangerous-or-worse rating and should be sold. Figure 4 shows the rating landscape of all small-cap value ETFs and mutual funds.

Our style roadmap report ranks all styles and highlights those that offer the best investments.

Figure 4: Separating the Best Funds From the Worst Funds

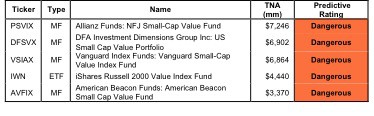

Figure 5 lists our Predictive Fund Rating for the 5 largest and most popular small-cap value funds.

Figure 5: Five Largest Small-cap Value Funds

* MF designates Mutual Funds and ETF designates Exchange-Traded Funds

* MF designates Mutual Funds and ETF designates Exchange-Traded Funds

* Analysis uses the top-ranked class for each fund

Sources: New Constructs, LLC and company filings

Review my full list of ratings and rankings along with free reports on all 327 small-cap value funds.

Disclosure: I receive no compensation to write about any specific stock, sector or theme.