The Financials sector ranks last out of the ten sectors as detailed in my sector roadmap. It is the only sector to earn my Very Dangerous rating, which is based on aggregation of ratings of 48 ETFs and 224 mutual funds in the Financials sector as of April 18, 2012. Reports on the best & worst ETFs and mutual funds in every sector and style are on my blog and Trading Deck.

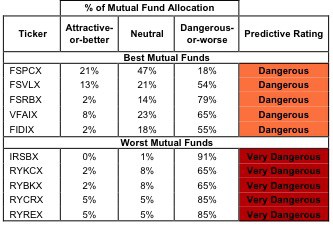

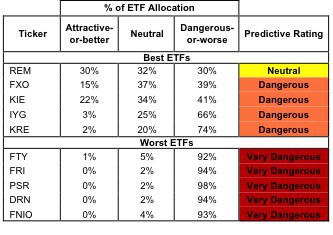

Figures 1 and 2 show the five best and worst-rated ETFs and mutual funds in the sector. The best ETFs and mutual funds allocate more value to Attractive-or-better-rated stocks than the worst, which allocate too much value to Neutral-or-worse-rated stocks. Note that all 5 of the worst ETFs allocate over 90% of their value to Dangerous-or-worse-rated stocks.

To identify the best and avoid the worst ETFs and mutual funds within the Financials sector, investors need a predictive rating based on (1) stocks ratings of the holdings and (2) the all-in expenses of each ETF and mutual fund. Investors need not rely on backward-looking ratings. My fund rating methodology is detailed here.

Investors should not buy any Financials ETFs or mutual funds because none get an Attractive-or-better rating. If you must have exposure to this sector, you should buy a basket of Attractive-or-better rated stocks and avoid paying undeserved fund fees. Active management has a long history of not paying off.

See ratings and reports on all ETFs and mutual funds in this sector on my free mutual fund and ETF screener.

Figure 1: ETFs with the Best & Worst Ratings – Top 5

* Best ETFs exclude ETFs with TNA’s less than 100 million for inadequate liquidity.

* Best ETFs exclude ETFs with TNA’s less than 100 million for inadequate liquidity.

Sources: New Constructs, LLC and company filings

PowerShares KWB Capital Markets Portfolio [s: KBWC], PowerShares Dynamic Insurance [s: PIC], and SPDR S&P Capital Markets ETF [s: KCE] are excluded from Figure 1 because their total net assets (TNA) are below $100 million and do not meet our liquidity standards.

Figure 2: Mutual Funds with the Best & Worst Ratings – Top 5

Sources: New Constructs, LLC and company filings

iSharesFTSE NAREIT Mortgage REITs Index Fund [s: REM] is my top-rated Financials ETF and earns my Neutral rating. Investors should avoid all Financials mutual funds since all of them earn my Dangerous-or-worse rating.

iShares FTSE NAREIT Industrial/Office Capped Index Fund [s: FNIO] is my worst-rated Financials ETF and Guggenheim Investments Real Estate Fund [s: RYREX] is my worst-rated Financials mutual fund. Both earn my Very Dangerous rating. Not only does RYREX hold poor quality stocks, it charges investors a whopping 6.19% in total annual costs, which places the fund in the 1st percentile of all 7000+ mutual funds and 400+ ETFs I cover.

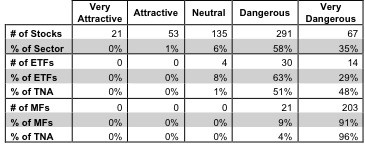

Figure 3 shows that 74 out of the 567 stocks (only 1% of the total net assets) held by Financials ETFs and mutual funds get an Attractive-or-better rating. This explains why no ETFs or mutual funds in the Financials sector earn an Attractive-or-better rating and only 4 ETFs and no mutual funds earn a Neutral rating.

The takeaways are: mutual fund managers allocate too much capital to low-quality stocks and Financials ETFs offer exposure to poor quality stocks.

Figure 3: Financials Sector Landscape For ETFs, Mutual Funds & Stocks

As detailed in “Cheap Funds Dupe Investors”, the fund industry offers many cheap funds but very few funds with high-quality stocks, or with what I call good portfolio management.

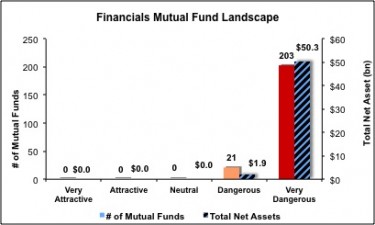

Investors should not buy any Financials ETFs or mutual funds, as none earn an Attractive-or-better rating. In fact, 44 of the 48 ETFs and all 224 mutual funds earn my Dangerous-or-worse rating and should be avoided. Instead, they should focus on Attractive-or-better individual holdings.

Aflac Inc. [s: AFL] is one of my favorite stocks held by Financials ETFs and mutual funds and earns my Attractive rating. Aflac has a proven track record of effectively allocating capital. Aflac’s return on invested capital (ROIC) of 15% is better than 85% of all Russell 3000 companies. Another highlight for Aflac is their ability to sustain growth. The company grew profits by an average of 14% a year over the past 14 years. Aflac’s strong ROIC and sustainable profits are two good reasons to recommend AFL.

Simon Property Group [s: SPG] is one of my least favorite stocks held by Financials ETFs and mutual funds and earns my Very Dangerous rating. In the worst sector, SPG is one of the worst stocks. SPG has misleading earnings – its economic earnings are negative and declining while its reported accounting earnings is positive and increasing. Making matters worse, SPG’s valuation (~$149.52) implies that profits will increase by 6.1% annually for 15 years. This is a high hurdle given that SPG has only cleared the 6.1% mark twice in the last nine years. Accounting window dressing and high expectations are two red flags for me and are why I recommend investors avoid SPG.

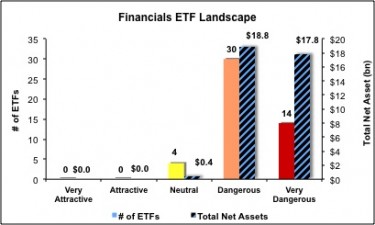

Figures 4 and 5 show the rating landscape of all Financials ETFs and mutual funds.

Our sector roadmap report ranks all sectors and highlights those that offer the best investments.

Figure 4: Separating the Best ETFs From the Worst ETFs

Sources: New Constructs, LLC and company filings

Sources: New Constructs, LLC and company filings

Figure 5: Separating the Best Mutual Funds From the Worst Mutual Funds

Sources: New Constructs, LLC and company filings

Sources: New Constructs, LLC and company filings

Review my full list of ratings and rankings along with free reports on all 48 ETFs and 224 mutual funds in the Financials sector.

Disclosure: I receive no compensation to write about any specific stock, sector or theme.