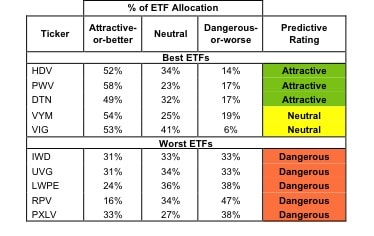

ETF Pair Trade To Navigate Shifty Tech Stocks

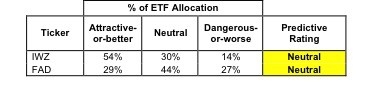

I have a pair trade (i.e. long/short) ETF strategy for investors who want to maximize upside potential and minimize downside risk in Technology stocks.

David Trainer, Founder & CEO