The Consumer Staples sector ranks first out of the ten sectors as detailed in my sector roadmap. It is the only sector to earn my Attractive rating, which is based on aggregation of ratings of ten ETFs and nine mutual funds in the Consumer Staples sector as of July 10, 2012. Reports on the best & worst ETFs and mutual funds in every sector and style are here.

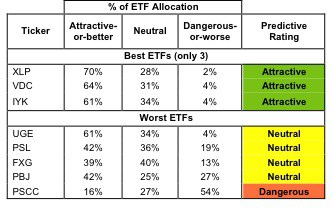

Figures 1 and 2 rank all eight ETFs and all eight mutual funds in the sector that meet our liquidity standards. Not all Consumer Staples sector ETFs and mutual funds are created the same. The number of holdings varies widely (from 23 to 122), which creates drastically different investment implications and ratings. The best ETFs and mutual funds allocate more value to Attractive-or-better-rated stocks than the worst ETFs and mutual funds, which allocate too much value to Neutral-or-worse-rated stocks.

To identify the best and avoid the worst ETFs and mutual funds within the Consumer Staples sector, investors need a predictive rating based on (1) stocks ratings of the holdings and (2) the all-in expenses of each ETF and mutual fund. Investors need not rely on backward-looking ratings. My fund rating methodology is detailed here.

Investors seeking exposure to the Consumer Staples sector should buy one of the Attractive-or-better rated ETFs or mutual funds from Figures 1 and 2.

See ratings and reports on all ETFs and mutual funds in this sector on my free mutual fund and ETF screener.

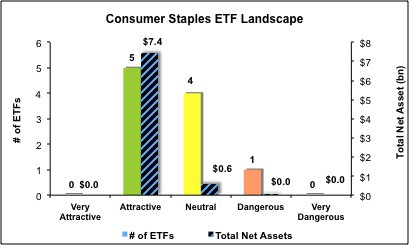

Figure 1: ETFs with the Best & Worst Ratings – Top 5 (where available)

* Best ETFs exclude ETFs with TNA’s less than 100 million for inadequate liquidity.

* Best ETFs exclude ETFs with TNA’s less than 100 million for inadequate liquidity.

Sources: New Constructs, LLC and company filings

Rydex S&P Equal Weight Consumer Staples ETF (RHS) and Focus Morningstar Consumer Defensive Index ETF (FCD) are excluded from Figure 1 because their total net assets (TNA) are below $100 million and do not meet our liquidity standards.

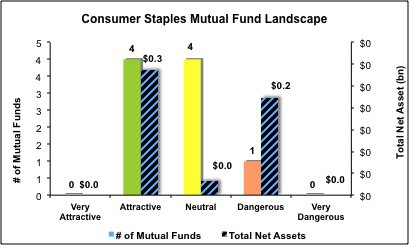

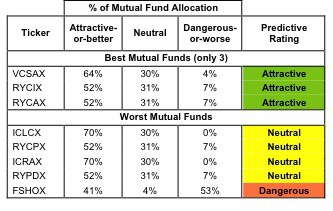

Figure 2: Mutual Funds with the Best & Worst Ratings – Top 5 (where available)

* Best mutual funds exclude funds with TNA’s less than 100 million for inadequate liquidity.

* Best mutual funds exclude funds with TNA’s less than 100 million for inadequate liquidity.

Sources: New Constructs, LLC and company filings

ICON Funds: ICON consumer Staples Fund (ICLEX) is excluded from Figure 2 because its total net assets (TNA) are below $100 million and do not meet our liquidity standards.

Consumer Staples Select Sector SPDR (XLP) is my top-rated Consumer Staples ETF and Vanguard World Funds: Vanguard Consumer Staples Index Fund (VCSAX) is my top-rated Consumer Staples mutual fund. Both earn my Attrative rating.

PowerShares S&P SmallCap Consumer Staples Portfolio (PSCC) is my worst-rated Consumer Staples ETF and Fidelity Select Portfolios: Construction & Housing Portfolio (FSHOX) is my worst-rated Consumer Staples mutual fund. Both earn my Dangerous rating.

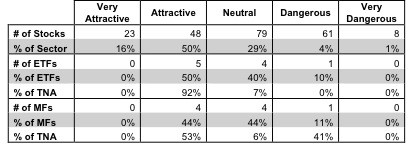

Figure 3 highlights that investors purchasing Consumer Staples ETFs and mutual funds are doing a great job of identifying investment worthy funds. 92% of the assets allocated to ETFs and 53% of assets allocated to mutual funds are allocated to funds with Attractive ratings. The main driver behind these Attractive ETFs and mutual funds is the heavy weighting (66% of the sector’s TNA) of Attractive-or-better-rated stocks.

The takeaways are: Consumer Staples mutual fund managers are doing a great job of identifying investment worthy holdings and investors are able to identify these Attractive funds.

Figure 3: Consumer Staples Sector Landscape For ETFs, Mutual Funds & Stocks

As detailed in “Cheap Funds Dupe Investors”, the fund industry offers many cheap funds but very few funds with high-quality stocks, or with what I call good portfolio management.

The Consumer Staples sector offers investors excellent investment opportunities. 50% of all ETFs (5) and 44% of all mutual funds (4) allocate enough value to Attractive-or-better-rated stocks to earn an Attractive rating. The heavy weightings of TNA in these Attractive funds shows that investors are allocating their capital to be best available investments.

Hormel Foods Corp (HRL) is one of my favorite stocks held by Consumer Staples ETFs and mutual funds and earns my Very Attractive rating. HRL has increased free cash flow each year since 2008, raising it from $77 million to $312 million in 2011. In spite of strong past performance, HRL’s current stock price of (~$29.38) implies that after-tax profits (NOPAT) will permanently decrease by 10%. Low expectations make HRL an excellent long candidate.

United Natural Foods, Inc (UNFI) is one of my least favorite stocks held by Consumer Staples ETFs and mutual funds and earns my Very Dangerous rating. UNFI has misleading earnings, meaning that it reports accounting profits when it is actually generating economic losses. Over the 14 years of coverage I have on UNFI, only once has it managed to generate a positive free cash flow (FCF). UNFI’s downside risks far out way its upside potential.

Figures 4 and 5 show the rating landscape of all Consumer Staples ETFs and mutual funds.

Our sector roadmap report ranks all sectors and highlights those that offer the best investments.

Figure 4: Separating the Best ETFs From the Worst ETFs

Figure 5: Separating the Best Mutual Funds From the Worst Mutual Funds

Review my full list of ratings and rankings along with free reports on all ten ETFs and nine mutual funds in the Consumer Staples sector.

Disclosure: I receive no compensation to write about any specific stock, sector or theme.