Each quarter, we provide the most comprehensive review of equity ETFs and mutual funds available. We continue our Best & Worst ETFs & Mutual Funds series with our Style Roadmap report. which details the best styles for finding quality ETFs and mutual funds. Next we highlight the ETFs and mutual funds that stand out as the Best & Worst among all the styles. We follow with detailed reviews of the Best & Worst within each style. Details on the Best & Worst Sector fund are here.

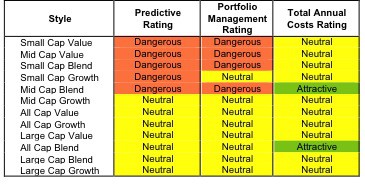

None of the fund styles earn a rating better than Neutral. See Figure 1 for my rankings on all twelve investment styles. My style ratings are based on the aggregation of my fund ratings for every ETF and mutual fund in each style.

Investors looking for style funds that hold quality stocks should focus on Large Cap and All Cap styles. They are the only styles with any Attractive-or-better-rated funds. Figures 4 and 6 provide details. The primary driver behind an Attractive fund rating is good portfolio management, or good stock picking, with low total annual costs.

Note that the attractive-or-better Predictive ratings do not always correlate with attractive-or-better total annual costs. This fact underscores that (1) low fees can dupe investors and (2) investors should invest only in funds with good stocks and low fees.

See Figures 4 through 13 for a detailed breakdown of ratings distributions by investment style. See my free ETF & mutual fund screener for rankings, ratings and free reports on 7000+ mutual funds and 400+ ETFs. My fund rating methodology is detailed here.

All of my reports on the best & worst ETFs and mutual funds in every sector and investment style are available here.

Figure 1: Ratings For All Investment Styles

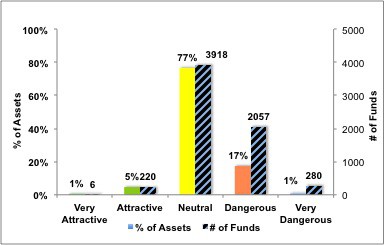

To earn an Attractive-or-better Predictive Rating, an ETF or mutual fund must have high-quality holdings and low costs. Only 226 (3.5% of the total) style ETFs and mutual funds meet these requirements

GMO Trust: GMO Quality Fund (GQETX) is one of my top-rated Large Cap Blend mutual funds. It earns my Very Attractive rating by allocating over 62% of its value to Attractive-or-better-rated stocks and charges investors a reasonable 0.61% in total annual costs.

Cisco Systems, Inc. (CSCO) is one of my favorite stocks held GQETX. CSCO has proven its ability to effectively allocate capital by earning a return on invested capital (ROIC) over its weighted average cost of capital (WACC) in each of the past eight years. That performance makes CSCO a great company, CSCO is also a great stock because its current price (~$16.31) implies that profits (NOPAT) will permanently decrease by 30%. The market’s low expectations coupled with a proven track record of cash generation make CSCO a great long candidate.

Touchstone Funds Group Trust: Touchstone Small Cap Value Fund (TVOAX) is my worst Small Cap Value mutual fund. It earns my Very Dangerous rating by allocating over 75% of its value to Neutral-or-worse-rated stocks, and to make matters worse, charges investors 5.73% per year in total annual costs.

Kaiser Aluminum Corp (KALU) is one of my least favorite stocks held by TVOAX. KALU has misleading earnings – its economic earnings are negative and declining while its reported accounting earnings are positive and increasing. Investors should not rely on accounting earnings when assessing the profitability of a company, nor should they rely on any metrics based on accounting, e.g. P/E and EPS. KALU is not only less profitable than its accounting appears, it is also a bad stock. To justify its current stock price (~$52.71) the company must grow its NOPAT by 12.4% compounded annually for 23 years. This is a high hurdle for a company whose profits have declined in three of the past four years.

Figure 2 shows the distribution of our Predictive Ratings for all investment style ETFs and mutual funds.

Figure 2: Distribution of ETFs & Mutual Funds (Assets and Count) by Predictive Rating

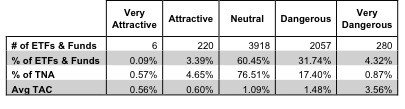

Figure 3 offers additional details on the quality of the investment style funds. Note that the average total annual cost of Very Dangerous funds is more than 6 times that of Very Attractive funds, per the last row of table 3.

Figure 3: Predictive Rating Distribution Stats

* Avg TAC = Weighted Average Total Annual Costs

* Avg TAC = Weighted Average Total Annual Costs

Source: New Constructs, LLC and company filings

This table shows that only the best of the best funds get our Very Attractive Rating: they must hold good stocks AND have low costs. Investors desrve to have the best of both and we are here to give it to them.

Ratings by Investment Style

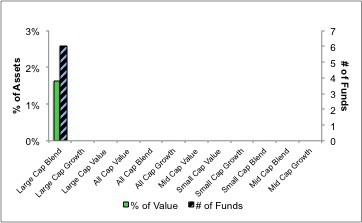

Figure 4 presents a mapping of Very Attractive funds by investment style. The chart shows the number of Very Attractive funds in each investment style and the percentage of assets allocated to Very Attractive-rated funds in each style.

Only 6 investment style funds earn our Very Attractive rating.

Figure 4: Very Attractive ETFs & Mutual Funds by Investment Style

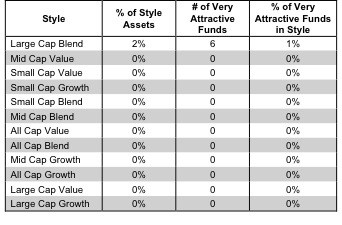

Figure 5 presents the data charted in Figure 4

Figure 5: Very Attractive ETFs & Mutual Funds by Investment Style

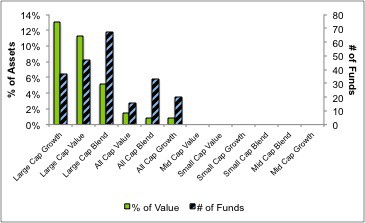

Figure 6 presents a mapping of Attractive funds by investment style. The chart shows the number of Attractive funds in each style and the percentage of assets allocated to Attractive-rated funds in each style.

Note that only the Large Cap and All Cap categories house Attractive-rated funds.

Figure 6: Attractive ETFs & Mutual Funds by Investment Style

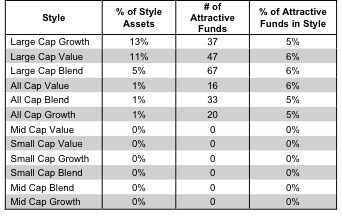

Figure 7 presents the data charted in Figure 6.

Figure 7: Attractive ETFs & Mutual Funds by Investment Style

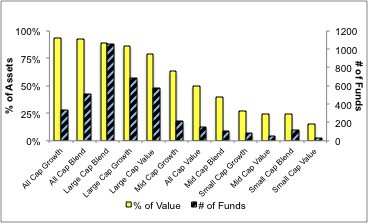

Figure 8 presents a mapping of Neutral funds by investment style. The chart shows the number of Neutral funds in each investment style and the percentage of assets allocated to Neutral-rated funds in each style.

Figure 8: Neutral ETFs & Mutual Funds by Investment Style

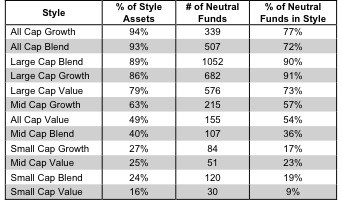

Figure 9 presents the data charted in Figure 8.

Figure 9: Neutral ETFs & Mutual Funds by Investment Style

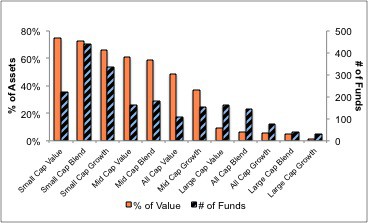

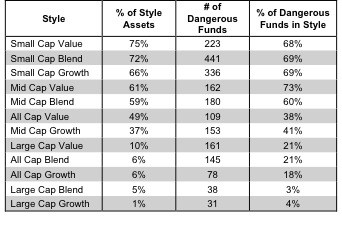

Figure 10 presents a mapping of Dangerous funds by fund style. The chart shows the number of Dangerous funds in each investment style and the percentage of assets allocated to Dangerous-rated funds in each style.

Small Cap style funds allocate, on average, over 60% of their assets to Dangerous-rated Funds.

Figure 10: Dangerous ETFs & Mutual Funds by Investment Style

Figure 11 presents the data charted in Figure 10.

Figure 11: Dangerous ETFs & Mutual Funds by Investment Style

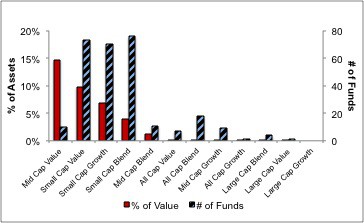

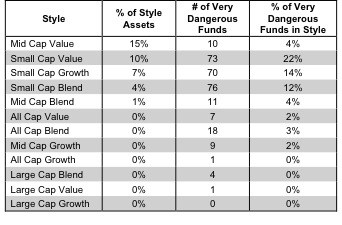

Figure 12 presents a mapping of Very Dangerous funds by fund style. The chart shows the number of Very Dangerous funds in each investment style and the percentage of assets allocated to Very Dangerous-rated funds in each style.

Figure 12: Very Dangerous ETFs & Mutual Funds by Investment Style

Figure 13 presents the data charted in Figure 12.

Figure 13: Very Dangerous ETFs & Mutual Funds by Investment Style

Disclosure: I am long CSCO. I receive no compensation to write about any specific stock, sector or theme.