The mid-cap blend style ranks eighth out of the twelve fund styles as detailed in my style roadmap. It gets my Dangerous rating, which is based on aggregation of ratings of 19 ETFs and 279 mutual funds in the mid-cap blend style as of July 19, 2012. Reports on the best & worst ETFs and mutual funds in every sector and style are here.

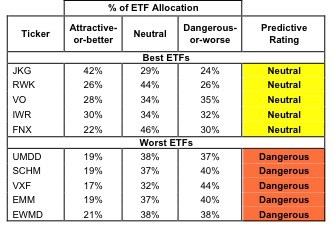

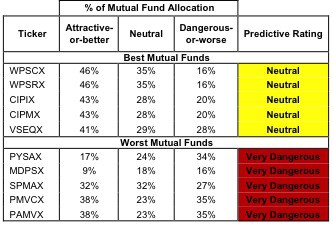

Figures 1 and 2 show the five best and worst-rated ETFs and mutual funds in the style. Not all mid-cap blend style ETFs and mutual funds are created the same. The number of holdings varies widely (from 24 to 3093), which creates drastically different investment implications and ratings. The best ETFs and mutual funds allocate more value to Attractive-or-better-rated stocks than the worst, which allocate too much value to Neutral-or-worse-rated stocks.

To identify the best and avoid the worst ETFs and mutual funds within the mid-cap blend style, investors need a predictive rating based on (1) stocks ratings of the holdings and (2) the all-in expenses of each ETF and mutual fund. Investors need not rely on backward-looking ratings. My fund rating methodology is detailed here.

Investors should not buy any mid-cap blend ETFs or mutual funds because none get an Attractive-or-better rating. If you must have exposure to this style, you should buy a basket of Attractive-or-better rated stocks and avoid paying undeserved fund fees. Active management has a long history of not paying off.

See ratings and reports on all ETFs and mutual funds in this style on my free mutual fund and ETF screener.

Figure 1: ETFs with the Best & Worst Ratings – Top 5

* Best ETFs exclude ETFs with less NAV’s less than 100 million.

* Best ETFs exclude ETFs with less NAV’s less than 100 million.

Sources: New Constructs, LLC and company filings

Four ETFs are excluded from Figure 1 because their total net assets (TNA) are below $100 million and do not meet our liquidity standards.

Figure 2: Mutual Funds with the Best & Worst Ratings – Top 5

* Best mutual funds exclude funds with NAV’s less than 100 million.

* Best mutual funds exclude funds with NAV’s less than 100 million.

Sources: New Constructs, LLC and company filings

14 mutual funds are excluded from Figure 2 because their total net assets (TNA) are below $100 million and do not meet our liquidity standards.

iShares Morningstar Mid Core Index Fund (JKG) is my top-rated mid-cap blend ETF and Westport Funds: Westport Select Cap Fund (WPSCX) is my top-rated mid-cap blend mutual fund. Both earn my Neutral rating.

Rydex S&P MidCap 400 Equal Weight ETF (EWMD) is my worst-rated mid-cap blend ETF and Pacific Advisors Fund Inc: Mid Cap Value Fund (PAMVX) is my worst-rated mid-cap blend mutual fund. EWMD earns my Dangerous rating and PAMVX earns my Very Dangerous rating.

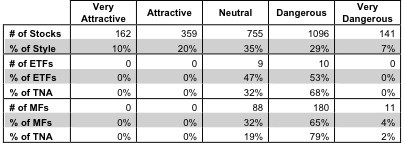

Figure 3 shows that 521 out of the 2513 stocks (over 30% of the total net assets) held by mid-cap blend ETFs and mutual funds get an Attractive-or-better rating. However, there are not any mid-cap blend ETFs or mutual funds that get an Attractive-or-better rating.

The takeaways are: mid-cap blend mutual fund managers pick poor stocks and mid-cap blend ETFs hold poor stocks.

Figure 3: Mid-cap Blend Style Landscape For ETFs, Mutual Funds & Stocks

* Ratings distribution of stocks applies only to stocks within our coverage universe.

* Ratings distribution of stocks applies only to stocks within our coverage universe.

Sources: New Constructs, LLC and company filings

As detailed in “Cheap Funds Dupe Investors”, the fund industry offers many cheap funds but very few funds with high-quality stocks, or with what I call good portfolio management.

Investors need to tread carefully when considering mid-cap blend ETFs and mutual funds, because all mid-cap blend ETFs are rated either Neutral or Dangerous and 69% of mid-cap blend mutual funds are rated Dangerous-or-worse. If investors want exposure to the mid-cap blend style, they should focus on owning a basket of Attractive-or-better-rated individual stocks, and avoid these Neutral-or-worse-rated ETFs and mutual funds.

Check Point Software Technologies (CHKP) is one of my favorite stocks held by mid-cap blend ETFs and mutual funds and earns my Very Attractive rating. Check Point is one of the leading stars in the network security industry and their steady accumulation of market share has been accompanied by double-digit revenue growth every year since 2007 and widening pre-tax operating margins (NOPBT margin up to over 50% in 2011). There can be no doubt that the operations of the business are profitable and growing. The truest measure of a company’s profitability is its returns on invested capital (ROIC), and this is where CHKP really shines. Checkpoint has nearly doubled its ROIC since 2009, from 44.7% to 89.1%. Consider what those impressive numbers mean: every dollar invested in CHKP’s business generated $0.89 of after-tax operating profits (NOPAT) in 2011. That’s a staggering level of capital efficiency and operating profitability. This is a great company, and right now, it’s a great stock because the market’s current price (~$50.00) implies that CHKP’s profitability growth will screech to a halt and profits will permanently decline by 7%. Unduly low expectations for future cash flows make CHKP a Very Attractive stock.

Accelrys Inc. (ACCL) is one of my least favorite stocks held by mid-cap blend ETFs and mutual funds and earns my Very Dangerous rating. ACCL has consistently eroded shareholder value by earning an ROIC less than its weighted-average cost of capital (WACC). Furthermore, ACCL went on an acquisition spree over 2010-2011, more than doubling the amount of capital invested in the business ($58 million in 2009 to $200 million in 2011). That’s more than $140 million dollars on which ACCL must earn a return higher than its cost of capital. Inorganic growth can signal that the market’s high expectations for growth are starting to catch up with the company. In order to meet the expectations implied by the current market price, ACCL would need to grow its profits by 23% compounded annually for the next 15 years. High expectations for future profits compared to poor past profits make this company’s stock extremely risky.

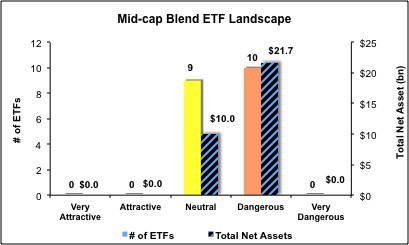

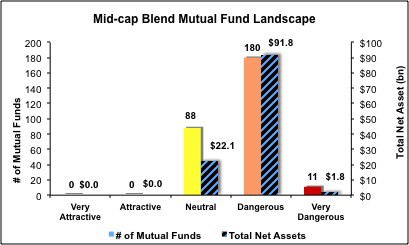

Figures 4 and 5 show the rating landscape of all mid-cap blend ETFs and mutual funds.

Our style roadmap report ranks all styles and highlights those that offer the best investments.

Figure 4: Separating the Best ETFs From the Worst Funds

Figure 5: Separating the Best Mutual Funds From the Worst Funds

Review my full list of ratings and rankings along with free reports on all 19 ETFs and 279 mutual funds in the mid-cap blend style.

Disclosure: I own CHKP. I receive no compensation to write about any specific stock, sector, style or theme.