Sometimes, picking stocks is easy if you focus on the basic principles of cash flows, valuation and competitive advantage.

Buying Exxon Mobil (XOM) now is one of the easiest calls in the market these days. With superior cash flows, a cheap valuation and one of the strongest competitive positions in the business world, it is hard to make a straight-faced argument against owning this stock anywhere below $100. My model shows the stock is worth $140 if one assumes profits never grow from 2011 levels, i.e. the “no-growth” value of the stock.

I will never forget how my first boss at Arthur Andersen in Houston, back when I was a newly minted accountant in 1995, told a group of us at lunch to ignore all the hype in the stock market. His name was Charlie, and he was the first person to ever give me stock market advice. His message was simple: (1) put your money in the best companies in businesses that will be around forever and (2) then check back in 15 to 20 years.

As an example of how he implemented this strategy, Charlie told us to buy XOM, which since 1995 has returned 478% compared to 206% for the S&P500. Charlie was right back in 1995 and he is right today.

My regular readers know that my investment strategy does not rely on past performance so my recommendation to buy XOM is not based on XOM’s past price performance. It is based on the basic principles of investing or what I call Investment Strategy 101, which in many ways is the analytical process of identifying companies that fit Charlie’s definition of a good stock.

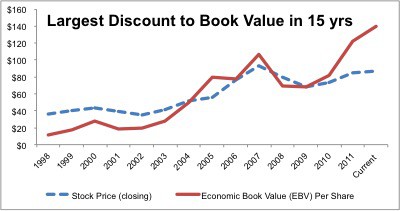

Figure 1: World-Leading Cash Flows Come From High ROIC

Figure 1 shows that XOM’s ROIC has been well above its cost of capital (WACC) for most of the last 14 years. XOM is one of the most profitable companies in the world. Cash flows are not an issue because over time XOM’s management has allocated capital to projects and investments that produce above-average returns. That is the definition of good management. Intelligent capital allocation has been a hallmark of XOM management for as long as I can remember. That greatly reduces the risk of putting money in this stock.

Risk in this stock is further lowered by the market’s valuation of XOM. At ~$87, the current valuation implies the company’s cash flows will permanently decline by nearly 40%. In other words, the market is not only giving XOM no credit for future cash flow growth, it is valuing it as if its profits will drop 40% next year and never grow again.

Note that the market’s valuation is considerably more pessimistic than analysts’ expectations for revenue and earnings. The lowest estimates for revenue forecast about a 20% drop. The lowest estimates for EPS forecast a 25% drop.

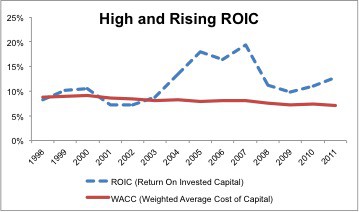

Figure 2 shows how XOM’s stock compares to its economic book value (EBV) since 1998 when my model starts. Never has the price-to-EBV ratio been as low for XOM as it is now. The current economic book value, aka “no growth value”, for XOM is $140. Such a low valuation presents investors with great upside potential. As mentioned above, the no-growth value of the stock is $140.

Figure 2: Stock Price Is Only About 60% of Economic Book Value

Bears on XOM will say that the company is too dependent on oil prices and the economy. They are correct that the stock has moved in sympathy with oil prices, which, in turn, have moved in sympathy with expectations for global growth. Long-term, however, global growth will resume and XOM will maintain its position as the largest energy company in the world.

Bears may also point to declining crude oil reserves and the attendant lower margins. My response is that XOM has been consistently and deliberately diversifying its energy production sources to ensure its reserves (across all types of energy) remain strong. In fact, the company’s proven reserves replacement ratio has been above 100% for 18 consecutive years.

International risks are mitigated by the company investing less in E&P of foreign reserves and more in building plants and processing for their foreign clients. The focus is shifting away from production to providing capital and expertise for getting the most out of client reserves.

Few will attempt to argue that the demand for energy is going anywhere but up over the foreseeable future. XOM is well-positioned to continue to profit from being one of the most efficient producers of energy.

My rating on the stock is Very Attractive. Click here for more details on my XOM rating and the list ETFs and funds that allocate 10% or more to XOM.

Below are two funds that get my Attractive-or-better rating and allocate significantly to XOM. Note that very few Energy Sector ETFs or mutual funds get an Attractive-or-better rating from me. For details, see my report on the Best & Worst Energy Sector ETFs and Mutual Funds.

- Invesco Van Kampen Exchange Fund (ACEHX) – Attractive Rating – 14% allocation to XOM

- WisdomTree LargeCap Value Fund (EZY) – Attractive Rating – 11% allocation to XOM

Disclosure: I am long XOM. I receive no compensation to write about any specific stock, sector or theme.

1 Response to "Slow & Steady Wins The Race: Buy XOM"

Great call on CSCO!!

–Chip.