The Danger Zone Pick: 10/29/12

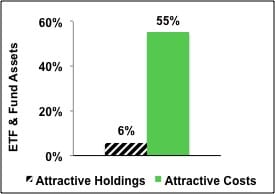

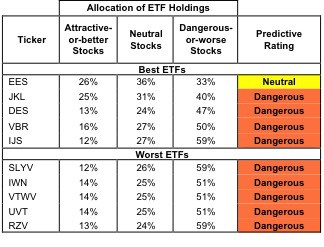

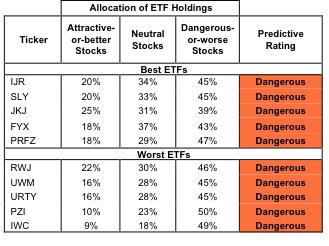

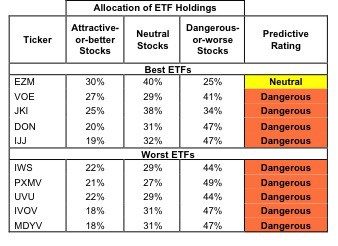

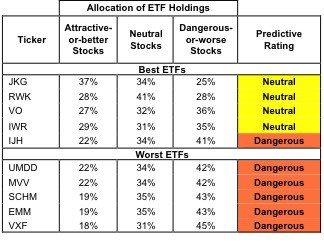

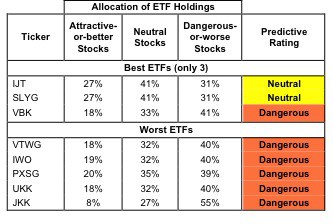

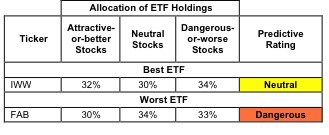

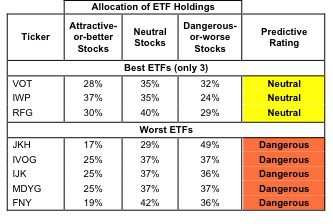

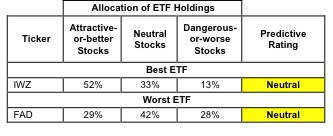

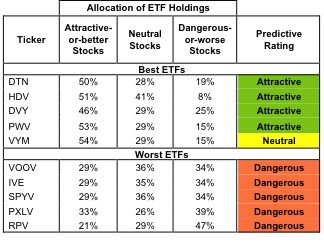

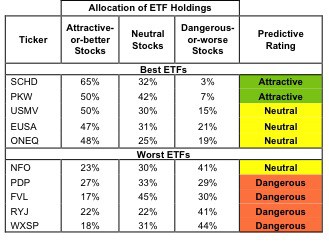

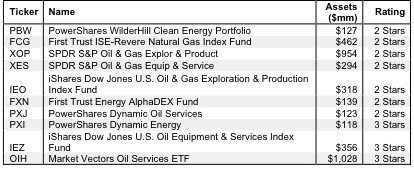

Check out my latest Danger Zone interview with Chuck Jaffe of MarketWatch.com. This week all Small Cap funds are in the Danger Zone.

David Trainer, Founder & CEO