Two factors drive my overall rating of an ETF:

Most investors are excellent at assessing the costs of funds. However, my study of ETF (and mutual funds) shows that investors are not good at assessing the quality of an ETF’s holdings.

As detailed in Low Costs Dupe Investors, 55% of fund assets are in ETFs and mutual funds with low costs but only 6% of assets are in ETFs and mutual funds with Attractive holdings. This discrepancy is astounding and it speaks to the lack of research and transparency into fund holdings. I am working to change that.

One of the best examples of an ETF with low costs but poor holdings is Schwab US REIT (SCHH).

With total annual costs of 0.08%, SCHH is one of the cheapest ETFs I cover. Per “How To Avoid the Worst ETFs”, SCHH costs are well below the average total annual cost (0.55%) of the 177 US equity ETFs I cover.

However, an ETF’s performance is determined more by its holdings than its costs. Per my report on SCHH, this ETF’s holdings are really poor. Over 95% of its portfolio is in stocks that get my Very Dangerous or Dangerous ratings. This ETF holds no stocks that get an Attractive or better rating.

So, despite its very low costs, SCHH offers investors little hope for good performance because its holdings are poor. No matter how cheap, if it holds bad stocks, the ETF’s performance will be bad. Sometimes, you get what you pay for.

The Danger Within

Buying an ETF without analyzing its holdings is like buying a stock without analyzing its business and finances. As Barron’s says, investors should know the Danger Within. Put another way, research on ETF holdings is necessary due diligence because an ETF’s performance is only as good as its holdings’ performance.

PERFORMANCE OF ETF’s HOLDINGs = PERFORMANCE OF ETF

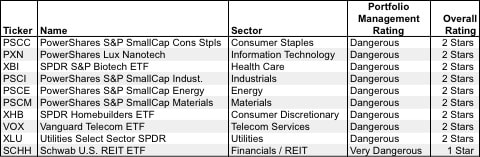

Figure 1 shows the ETFs within each sector with the worst holdings or portfolio management ratings. The sectors are listed in descending order by overall rating as detailed in my 4Q Sector Ratings report.

Figure 1: Sector ETFs With Worst Holdings

Find the ETFs with the worst overall ratings on my ETF screener. More analysis of the Best Sector ETFs is here.

Worst Stock in SCHH

Simon Property Group (SPG) is one of worst stocks I cover. It is the top holding (12% of assets) of SCHH. SPG earns my Very Dangerous rating. SPG has misleading earnings – its economic earnings are negative and declining while its reports accounting earnings are positive and increasing. During the 14 years in my model, the company has never generated positive economic earnings. Not only is SPG not profitable, it is also overvalued. To justify its current stock price (~$155), the company must increase profits by 12.3% compounded annually for 20 years. That is a lot of future value creation for a company that has never created value. Investors should avoid this stock.

Disclosure: I receive no compensation to write about any specific stock, sector or theme.