Check out this week’s Danger Zone interview with Chuck Jaffe of Money Life and MarketWatch.com.

Office Max Inc. (OMX) is in the Danger Zone this week. Poor capital allocation decisions and the rise of online vendors put Office Max in a precarious position. More on the ETFs and mutual funds that hold OMX is at the end.

Simply put, I think Office Max is going to follow the same path as Circuit City and Best Buy. Physical stores just tie up too much capital. Office Max is at a huge disadvantage to the pure online vendors, who can offer the same selection without the cost of building and maintaining stores.

Close inspection of the financial footnotes reveals the early signs of decay in OMX’s business. Two major issues show up on the balance sheet (a good place to hide issues, as the majority of investors focus on the income statement).

For one, OMX has about $1 billion in off balance sheet debt. This is roughly equal to a third of the net assets on the balance sheet, and 10% more than the total market capitalization of the company. Add that to the $1.7 billion in debt already on the balance sheet, and OMX’s debt load is much larger than many investors may realize.

More concerning, though, is the nearly $2 billion in asset write-downs. Most of these write-downs have occurred over the past four years, a sign that OMX has been destroying a lot of value recently. With the handicap of having so much capital tied up in bricks and mortar, OMX’s management needs to make quality investments with their remaining capital. Instead, they have been making many bad investments. Write-downs can hide management failure because the accounting rules do not require companies to keep track of them properly. For more details on how I track write-downs for over 3000 companies, click here.

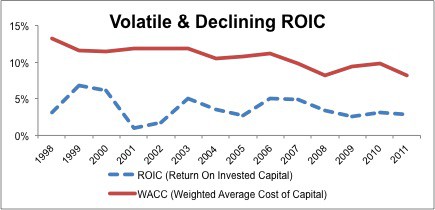

These issues have helped to drive down the return on invested capital (ROIC) of OMX down to 3%. It would need to nearly triple this ROIC to exceed its weighted average cost of capital (WACC) of 8.2%. I don’t see a way for OMX to raise its ROIC by this much, if at all.

Figure 1: Decline In ROIC Is Bad Omen

OMX has only grown its after tax cash flow (NOPAT) by 1% compounded annually over the past 14 years. Over the past five years, the NOPAT CAGR is -12%.

And yet, OMX stock is up nearly 90% in the past year. The valuation is completely out of line with recent cash flows. My discounted cash flow model shows that OMX’s share price of ~$10.70 implies the company will grow its NOPAT at 6% compounded annually for the next 16 years.

Those expectations are absurdly high for a company facing the competitive pressures posed by online competitors like Amazon (AMZN).

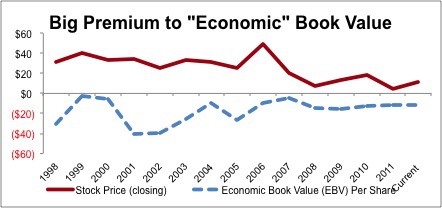

Figure 2: Beware: Economic Book Value is Negative

Holding OMX stock is betting that this company is going to buck a long trend of poor performance. Even in normal conditions that is a bold prediction. When the online vendors have a leg up on OMX, such a bet appears unduly risky.

I recommend selling and/or avoiding the following ETFs and mutual funds because of their large allocation to OMX and their Neutral or worse rating.

- Oceanstone Fund (OSFDX) – 8.5% allocation and Very Dangerous rating

- Investment Managers Series Trust: Towle Deep Value Fund (TDVFX) – 4.6% allocation and Dangerous rating

- Neuberger Berman Equity Funds: Neuberger Berman Intrinsic Value Fund (NINAX) – 3.8% allocation and Very Dangerous rating

- PowerShares Dynamic Retail (PMR) – 2.9% allocation and Neutral rating

- Franklin Value Investors Trust: Franklin Balance Sheet Investment Fund (FRBSX) – 2.3% allocation and Very Dangerous rating

Disclosure: Sam McBride contributed to this post.

David Trainer and Sam McBride receive no compensation for writing about any specific stock, sector, or theme.