We closed this position on February 24, 2015. A copy of the associated Position Update report is here.

Check out this week’s Danger Zone interview with Chuck Jaffe of Money Life and MarketWatch.com.

Express Scripts, Inc. (ESRX) is in the Danger Zone this week. An array of misleading accounting practices—including valuation of intangible assets, compensation through employee stock options, unusual pension assumptions—help to make this company appear more valuable than it really is. Most of this strange accounting relates to ESRX’s $29 billion acquisition of Medco Health Solutions in April of 2012.

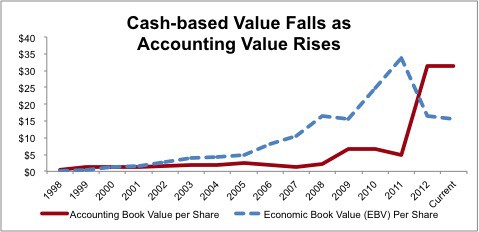

Usually I take issue with companies using mergers to artificially boost earnings per share while actually decreasing economic earnings (see “Earnings Accretion is a Myth: Sell HOLX”). While that is an issue here, an even bigger issue is the way this merger has boosted ESRX’s accounting book value six-fold while reducing its economic book value (EBV) by over 50%.

Figure 1: Accounting Book Value (ABV) Rises to 2x Economic Book Value (EBV)

Traditional measures of accounting book value use the book value of assets while often ignoring significant liabilities. Here’s a rundown of the (often ignored) liabilities we found in the 2012 10-K s:

1) Employee Stock Options (ESO) —ESRX nearly quadrupled its outstanding ESO in 2012, from 13.7 million to 44.2 million. This has brought its total ESO liability to over $730 million. ESO liabilities dilute shareholder value by reducing the future cash flows attributable to current stockholders. The model showing my calculations for ESO liability can be seen here (note: those calculations reflect the liability at the end of 2012 and don’t reflect the impact of appreciation in the share price in 2013).

2) Underfunded Pensions—Pension accounting is one of the murkier aspects of corporate finance, and underfunded pensions are both rampant (only 18 S&P 500 companies had fully funded pensions according to a report in July of 2012) and dangerous (serious pension underfunding led Eastman Kodak into bankruptcy). ESRX’s situation is not nearly that dire, but it has taken on a reported $64 million in underfunded pension obligations due to Medco employees.

3) Deferred tax liabilities: ESRX took on $5.5 billion in net deferred tax liabilities in 2012, almost all of which is attributable to goodwill from its purchase of Medco. This is money the company will have to eventually pay, decreasing the amount of future cash flows available to shareholders.

4) True total debt: ESRX has $240 million in off-balance sheet debt due to operating leases and $545 million in outstanding checks not yet presented for payment (click here for details). Both of these claims are senior to equity investors’ and raise total debt from the reported $15.9 billion to $16.7 billion, an increase of almost $1 per share.

Overlooking these hidden liabilities undermines the analytical merit of accounting book value. It’s analytical merit is further reduced by its inclusion of goodwill and other intangibles, which, at over $35 billion, is substantial after recent mergers.

The point is that accounting-based estimations of book values and intangible assets are opinions. My mesure of cash is much closer to fact. Accordingly, my measurement of economic book value deals with the present value of after-tax cash flows (NOPAT) rather than any accounting metrics. My formula for EBV is simple: I take NOPAT, divide by the Weighted Average Cost of Capital (WACC), add all non-operating assets (like excess cash) and then subtract liabilities (including those stated above). My EBV calculation for ESRX can be seen here (the far right column represents present values, the next represents 2012, then 2011 etc.).

This calculation gives us an economic book value per share of $15.72. With the current share price at ~$58.34, ESRX has a price to economic book value ratio of 3.7, implying significant future growth. Specifically, my discounted cash flow model shows that ESRX would have to grow NOPAT by 12% compounded annually for the next 10 years to justify its current valuation.

This is not an impossible growth expectation by any means, but it is very optimistic to project that level of profit growth onto any company, especially one that essentially operates as a middleman, ESRX makes money by charging drug buyers more than what they pay drug manufacturers. Drug buyers are under lots of pressure to reduce costs as is everyone in the health care business, which means ESRX will have a harder time pushing higher prices through. In other words, a stock valuation that implies 12% growth in NOPAT for 10 years is rich.

Investors should avoid ESRX because the business is not as profitable as it seems and the valuation is already pricing in an awfully optimistic future. Looks like all risk and no reward.

Investors should also avoid the following ETFs and mutual funds due to their Neutral-or-worse rating and heavy allocation to ESRX:

1) iShares Dow Jones U.S. Health Care Providers Index (IHF). 11% allocation to ESRX and Dangerous rating.

2) Janus Investment Fund: Janus Twenty Fund (JNTFX). 5% allocation to ESRX and Neutral rating.

Sam McBride contributed to this report

Disclosure: David Trainer and Sam McBride receive no compensation to write about any specific stock, sector, or theme.