This report is one of a series on the adjustments we make to convert GAAP data to economic earnings.

Reported earnings don’t tell the whole story of a company’s profits. They are based on accounting rules designed for debt investors, not equity investors, and are manipulated by companies to manage earnings. Only economic earnings provide a complete and unadulterated measure of profitability.

Converting GAAP data into economic earnings should be part of every investor’s diligence process. Performing detailed analysis of footnotes and the MD&A is part of fulfilling fiduciary responsibilities.

We’ve performed unrivaled due diligence on 5,500 10-Ks every year for the past decade.

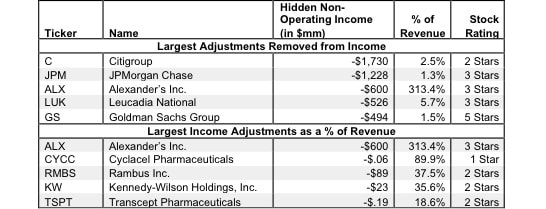

Non-operating items in operating income are unusual gains that don’t appear on the income statement because they are bundled in other line items. Without careful footnotes research, investors would never know that these non-recurring income items distort GAAP numbers by artificially raising operating earnings. Examples of hidden non-operating income include: gains on plan assets, gains on sale of assets, income from legal settlements, and gains from consolidation of property.

Our models remove this distortion to reveal a company’s recurring, core, net operating profit after tax: NOPAT.