This report is one of a series on the adjustments we make to GAAP data so we can measure shareholder value accurately. This report focuses on an adjustment we make to our calculation of economic book value and our discounted cash flow model.

We’ve already broken down the adjustments we make to NOPAT and invested capital. Many of the adjustments in this third and final section deal with how adjustments to those two metrics affect how we calculate the present value of future cash flows. Some adjustments represent senior claims to equity holders that reduce shareholder value while others are assets that we expect to be accretive to shareholder value.

Adjusting GAAP data to measure shareholder value should be part of every investor’s diligence process. Performing detailed analysis of footnotes and the MD&A is part of fulfilling fiduciary responsibilities.

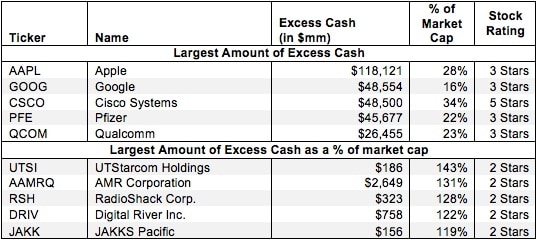

For most companies, we estimate the required amount of cash for normal business operations to be around 5% of sales. However, many companies hold cash or other liquid investments above and beyond this amount. We refer to this extra amount as excess cash. This surplus cash can be used for any number of purposes, including acquisitions, research and development, and cushioning the company against economic downturns. Excess cash is immediately available for distribution to shareholders, so we add a company’s excess cash to our calculation of shareholder value.

Excess cash can also affect a company’s invested capital calculation. We covered that adjustment in an earlier report.

7 replies to "Excess Cash – Valuation Adjustment"

Hello,

I´m wondering about your analysis results “We estimate that AAPL requires only ~2% of its cash for business operations”.

How did you perform your analysis to come with a number of approximately 2%? Could you go mor ein detail to compute your estimation?

Thank you and best regards

Philipp

Philipp,

As we state in the article, we estimate that most companies require ~5% of revenue in cash on hand to fund their operations. As Apple is an unusually profitable company, we assign it a slightly lower required cash ratio. We do the opposite for unprofitable companies, giving them a higher level of required cash. The 2% here is not a precise calculation but instead a rough estimate based Apple’s cash flow and industry convention.

Hi, If a company is incurring net operating losses, can they still have excess cash?

Yes, companies with net operating losses can still have excess cash. For companies whose margins are not too negative, we set their required cash at 25% of revenue, so anything over that is excess cash. Tesla (TSLA), for instance, has net operating losses but still over $800 million in excess cash.

Doesn’t adding excess cash to stockholders equity result in double counting because liabilities plus stockholders equity = assets. The cash is included in assets which is then reflected in a higher stockholders equity by the amount of cash?

Excess cash is not added to stockholder’s equity. We make valuation adjustments to our calculation of economic book value (the zero-growth value of the business) and our DCF models. We’re adding excess cash to the present value of future cash flows to calculate the entire amount of cash available to shareholders.

I agree that excess cash gives financial flexibility to the company like Google and Apple.However,enormous excess/idle cash and the resulting inefficient capital structure, constitute adversary for shareholders value; such would be appropriately punished by the market.