Check out this week’s Danger Zone interview with Chuck Jaffe of Money Life and MarketWatch.com.

E*Trade Babies, i.e. average online investors, are in the Danger Zone this week. Online trading firms aim to exploit the gullibility of many retail investors by encouraging the myth that they can outperform professional money managers armed with vastly greater resources, experience and expertise. The E*Trade babies are the most glaring symbol of this myth. The symbol also reinforces the notion that investing is an easy task that takes no special effort or aptitude to succeed.

The truth, of course, is that part time investors are at a huge disadvantage to Wall Street not just in terms of resources, experience and expertise but also in terms of the many forms of insider trading. Membership on Wall Street has its privileges…

Still, the biggest issue for part-time investors is that they often trade on emotions and gut feelings. Individual investors get caught up in the psychology of the market all too often. They are hooked on CNBC, stock forums and stock market apps telling them they need to act RIGHT NOW! They buy into certain “story” stocks without doing their due diligence and understanding the risks associated with their investments.

Over the past few weeks, I’ve highlighted several of these “story” stocks. There are significant differences in all of these companies, but they are all bound by the fact that exuberant investors continue to ignore the significant issues with each company while latching onto a positive narrative. Angie’s List (ANGI) investors ignore the company’s misleading business model. Tesla (TSLA) investors discount the impact of employee stock options and competition from the major auto companies. LinkedIn (LNKD) investors seem oblivious to the competitive weaknesses of the company and that its valuation implies it will be more profitable than Google (GOOG).

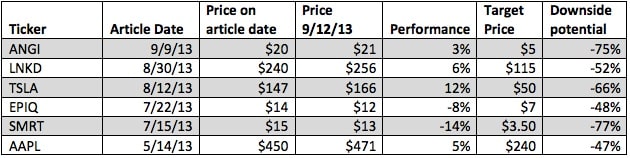

Figure 1 shows six stocks that were put in the Danger Zone this summer due to valuations that had more to do with emotions than fundamental analysis. Some, like Stein Mart (SMRT) have lots of momentum but not enough profits to back up their valuations. Other stocks, like Apple (AAPL) are value traps that only look attractive if one assumes their abnormal profitability can last forever. Some of these stocks have rolled over and are already correcting downward. Others continue higher and present even more risk, foolishly high risk.

Sources: New Constructs, LLC and company filings

I said earlier this summer that I don’t believe the stock market as a whole is in a bubble. There are, though, bubbles forming in certain parts of the market. Bubbles form when emotions override logic, and based on the attitudes around these stocks (and the vitriol I received in the comments when I wrote about them) emotions are the driving force behind their lofty valuations.

Emotion is what the financial media is selling. Emotions are entertaining. Unfortunately, investing is not meant to be entertainment. Rigorous, logical investing should be boring. Trading based on short-term price movements and emotional, knee-jerk reactions is not investing, it’s speculating. If you want to he a speculator or someone who aims to predict the near-term direction of price, be my guest. But know that myopic view is dangerous and may prevent you from seeing the cliff you are going over until it is too late.