Our Most Attractive and Most Dangerous stocks for February were made available to the public at midnight on Wednesday. January saw some strong performances from our picks, led by small-cap National Research Corporation (NRCIB), which gained 17%. Our Most Attractive feature from last month, Amgen (AMGN), held up well during the market correction and gained 1% while the S&P 500 declined by 5.2%. On the Dangerous side, Sears (SHLD) declined by 20% while Air Transport Services Group (ATSG) dropped 21%.

Our Most Attractive Stocks (-5.0%) narrowly outperformed the S&P 500 (-5.2%) in January, while our Most Dangerous Stocks (-5.8%) fell by more than the market and outperformed as a short portfolio last month.

February sees 13 new stocks on our Most Attractive list and 9 new stocks fall into the Most Dangerous category.

Our Most Attractive stocks have high and rising return on invested capital (ROIC) and low price to economic book value ratios. Most Dangerous stocks have misleading earnings and long growth appreciation periods implied in their market valuations.

Most Attractive Stock Feature For February: MYGN

Myriad Genetics (MYGN) is one of the new additions to the Most Attractive list this month. MYGN makes the list due to the decrease in rank of other stocks that were ahead of it.

MYGN offers investors a rare combination of growth and value. MYGN has grown after-tax profit (NOPAT) by 28% compounded annually over the past five years. Over that same time, it has increased its ROIC from 15% to 56%.

Multiple events in the news have kept MYGN stock depressed over the past year. First, the Supreme Court ruled that Myriad’s patents on genomic DNA were ineligible in June of 2013. This ruling meant that other companies could offer competing tests to Myriad’s BRACAnalysis test for hereditary breast and ovarian cancer, which made up 75% of its revenue in 2013. MYGN fell almost 20% in the wake of this ruling.

Then, in December, the Centers for Medicare and Medicaid Services (CMS) cut reimbursement rates for the test by almost 50%. The stock fell 30% after this announcement. These two events led to MYGN declining by 20% in 2013, even as the company grew NOPAT by 28%.

The Supreme Court decision and the CMS cut are less damaging to MYGN than they seem. For one, MYGN’s proprietary database of genetic mutations is unmatched and gives the company an advantage over the new competitors that have come in to the field after the Supreme Court ruling. Even with new competition, BRACAnalysis revenue grew 28% year over year in the last quarter.

Additionally, Medicare patients make up only 10% of MYGN’s revenue for its BRACAnalysis tests, so the impact of the reimbursement rate cut (which is still open for public comment and could be reversed) will not be a massive blow to MYGN’s revenues. So far no private payers have given any sign that they will follow CMS’s lead and cut rates. Even if they do, MYGN plans to phase out its BRACAnalysis test in the coming years and replace it with the MyRisk Hereditary Cancer Panel, which will test 25 different genes.

Through all of this, MYGN’s growth has actually accelerated, as it grew revenues by 44% year-over-year for the first half of its 2014 fiscal year. This is still a company that is growing rapidly.

The market is not valuing MYGN as a growth company, however. At its current valuation of ~$31/share, MYGN has a price to economic book value ratio of 1.1, which implies that the company will grow NOPAT by only 10% for the remainder of its corporate life. MYGN should easily surpass that expectation just in 2014.

In addition to strong earnings and a cheap valuation, MYGN has a healthy balance sheet. At the end of fiscal year 2013 MYGN had over $500 million in excess cash. This cash pile has allowed MYGN to buy Crescendo Bioscience for $270 million while in the midst of a $300 million buyback program without taking on any debt. Management is diversifying the company’s revenue streams and returning money to shareholders without taking on any debt.

MYGN is up almost 50% already in 2014 due to strong earnings and a settlement that will keep one of its competitors out of North America. However, the stock remains a strong value at these levels with significant potential upside. In the short-term, the stock has nearly 50% short interest, which means a short-squeeze could lead to quick profits. In the long-term, the shift in our healthcare system to more preventative care should help MYGN to achieve sustainable growth.

Most Dangerous Stock Feature For February: LUV

Southwest Airlines (LUV) is one of the new additions to the Most Dangerous list this month. While most of the market has dropped this year, LUV has increased by 12% and become even more overvalued than it already was.

At first glance, LUV’s results from 2013 look like cause for optimism. Its ROIC grew from 4% to 6% while its NOPAT margin expanded from 3.5% to 5.5%. Overall the company grew NOPAT by an impressive 60%.

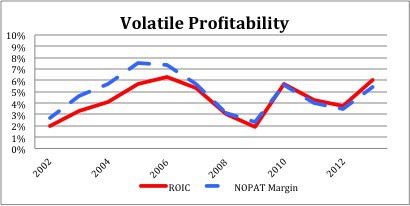

A look at LUV’s history, however, suggests that investors should dial back the optimism. Airlines are very cyclical businesses, and 2013 simply happens to be a peak for the company. Figure 1 shows how LUV’s profitability has swung back and forth in the past.

Figure 1: NOPAT Margin and ROIC

History shows that an ROIC of 6%, which LUV hit last year, is about the ceiling for this company. Adding more invested capital will be tough as well, as LUV is already leveraged pretty heavily with $6.6 billion in adjusted total debt (45% of market cap). $3.6 billion of that debt comes from off-balance sheet debt due to operatic leases. Using operating leases as a substitute for debt is a common practice in the airline industry.

If anything, the competitive landscape for LUV has become even more difficult with the recent merger between US Airways and American Airlines. LUV now has to face a competitor with a larger market share and greater resources.

The surge in LUV’s stock over the past year has made it dangerously overvalued. To justify its current valuation of ~$21/share, LUV would need to grow NOPAT by 9% compounded annually for 21 years. If the company was at the low point in its cycle that level of growth might be attainable, but we’re talking about a company at a cyclical peak. I don’t see LUV attaining the level of growth that the market expects.

The Most Dangerous Stocks report for February can be purchased here, while the Most Attractive Stocks can be purchased here. To gain access to these reports one week earlier each month, e-mail us at subscriptions@newconstructs.com to request a subscription.

Sam McBride contributed to this report.

Disclosure: David Trainer and Sam McBride receive no compensation to write about any specific stock, sector, or theme.