Check out this week’s Danger Zone Interview with Chuck Jaffe of Money Life and MarketWatch.com.

Small Cap Value funds are in the Danger Zone this week. In my most recent Best & Worst ETFs and Mutual Funds series, the Small Cap Value style ranks last out of the twelve styles. While the world of Small Caps tends to be an inherently volatile one, Small Cap Value funds hold too many risky stocks for investors to buy in.

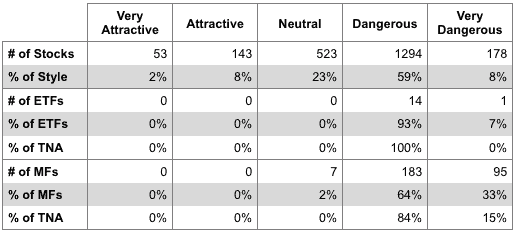

Of the 272 Small Cap Value ETFs and mutual funds under our coverage, only 7 mutual funds earn above a Dangerous rating. All 93% of Small Cap Value ETFs earn a Dangerous rating, and 33% of the mutual funds in the style earn my lowest Very Dangerous rating. Figure 1 shows the breakdown of the number of ETFs and mutual funds in each rating category relative to the number of stocks in that category.

Figure 1: Ratings Landscape for the Small Cap Value Style

Sources: New Constructs, LLC and company filings

Over a third of all Small Cap Value stocks earn a Neutral-or-better rating, but 98% of all funds in this style earn a Dangerous-or-worse rating. Fund managers are doing a poor job of allocating to good-quality stocks.

Even more disheartening is the fact that under 1% of the total net assets in Small Cap Value funds are invested in the funds that earn a Neutral rating. For example, the Bernzott U.S. Small Cap Value Fund (BSCVX) is my top-rated Small Cap Value mutual fund, allocating 51% of its portfolio to Neutral-or-better rated stocks. However, this fund has just $25 million in assets under management, compared with the $2.1 billion held by American Century Capital’s Small Cap Value Fund (ACSCX), which earns my Very Dangerous rating and allocates over 55% of its portfolio to Dangerous-or-worse rated stocks.

Even if investors cannot always identify quality holdings, they usually do a good job of staying away from funds with exorbitant fees. However, this cannot be said for the Small Cap Value style. ACSCX, with its $2.1 billion AUM, also has total annual costs of 5.26%. Only four funds in the entire style charge higher fees than ACSCX. I am confused as to why investors have flocked to ACSCX.

Entravision Communications Corp (EVC) is one of my least favorite stocks held by ACSCX and earns my Dangerous rating. EVC’s profits (NOPAT) have fallen by a rate of 6% compounded annually since 2006. Entravision also has a return on invested capital (ROIC) of just 4%, in the bottom quintile of all the companies I cover. EVC has over $811 million in asset write downs, an amount greater than twice the company’s current reported net assets. Despite this decline in profitability and poor capital allocation, the market valuation of the stock implies major profit growth. To justify its price of ~$6/share, EVC must grow NOPAT by 14% compounded annually for 28 years. EVC’s inability to grow its profits for more than 4 years in a row makes this target seem ambitious. Investors should avoid this stock until the company shows it deserves those expectations.

André Rouillard and Sam McBride contributed to this report.

Disclosure: David Trainer, André Rouillard, and Sam McBride receive no compensation to write about any specific stock, sector, or theme.

Photo credit: The Orkla Group