Fund holdings affect fund performance more than fees or past performance. A cheap fund is not necessarily a good fund. A fund that has done well in the past is not likely to do well in the future (e.g. 5-star kiss of death and active management has long history of underperformance). Yet, traditional fund research focuses only on low fees and past performance.

Our research on holdings enables investors to find funds with high quality holdings – AND – low fees.

Investors are good at picking cheap funds. We want them to be better at picking funds with good stocks. Both are required to maximize success.

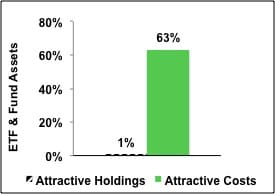

Figure 1 shows that 63% of fund assets are in ETFs and mutual funds with low costs but only 1% of assets are in ETFs and mutual funds with Attractive holdings. This discrepancy is astounding.

Figure 1: Allocation of Fund Assets By Holdings Quality and By Costs

Sources: New Constructs, LLC and company filings

Sources: New Constructs, LLC and company filings

Two key shortcomings in the ETF and mutual fund industry cause this large discrepancy:

- A lack of research into the quality of holdings.

- Not enough research focuses on the quality of Portfolio Management of funds

- A lack of high-quality holdings or good stocks.

- With about twice as many funds as stocks in the market, there simply are not enough good stocks to fill all the funds.

These shortcomings are related. If investors had more insight into the quality of funds’ holdings, I think they would allocate a lot less money to funds with poor quality holdings. Many funds would cease to exist.

Investors deserve research on the quality of stocks held by ETFs and mutual funds

Quality of holdings is the single most important factor in determining an ETF or mutual fund’s future performance. No matter how low the costs, if the ETF or mutual fund holds bad stocks, performance will be poor. Costs are easy to find but research on the quality of holdings is almost non-existent.

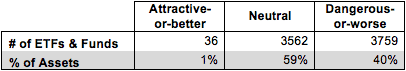

Figure 2 shows investors are not putting enough money into ETFs and mutual funds with high-quality holdings. Only 36 of 7357 (1% of assets) ETFs and mutual funds allocate a significant amount of value to quality holdings. 99% of assets are in funds that do not justify their costs and over charge investors for poor portfolio management.

Figure 2: Distribution of ETFs & Mutual Funds (Count & Assets) By Portfolio Management Rating

Source: New Constructs, LLC and company filings

Source: New Constructs, LLC and company filings

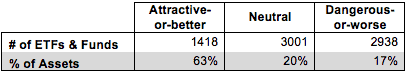

Figure 3 shows that Investors successfully find low-cost funds. 63% of assets are held in ETFs and mutual funds that have Attractive-or-better rated Total Annual Costs, my apples-to-apples measure of the all-in cost of investing in any given fund.

Out of the 7357 ETFs and mutual funds I cover, 1418 (63% of all assets) earn an Attractive-or-better Total Annual Costs rating.

Clearly, ETF and mutual funds investors are smart shoppers when it comes to finding cheap investments. But cheap is not necessarily good.

American Century Quantitative Equity Funds, Inc: Utilities Fund (BULIX) is a good example of a fund with low costs but poor holdings. Its total annual costs earn an Attractive rating. However it gets an overall predictive rating of Very Dangerous because no matter how low its fees, I expect it to underperform because it holds too many Dangerous-or-worse rated stocks. Low fees cannot boost fund performance. Only good stocks can boost performance.

Edison International (EIX) is one of my least favorite stocks held by BULIX and earns my Dangerous rating. EIX’s after tax profits (NOPAT) have only increased by 2% compounded annually over the past decade. The company’s return on invested capital (ROIC) has declined to 4%, down from 6% in 2003. EIX has also generated negative economic earnings every year for the past decade. Despite negative economic earnings and slow growth, EIX is priced like a high growth company. To justify its current price of ~$57/share, EIX would need to grow NOPAT by 6% compounded annually for the next 12 years. That growth expectation seems too high for a utility company with declining profitability.

Figure 3: Distribution of ETFs & Mutual Funds (Count & Assets) By Total Annual Costs Ratings

Source: New Constructs, LLC and company filings

Source: New Constructs, LLC and company filings

Investors should allocate their capital to funds with both high-quality holdings and low costs because those are the funds that offer investors the best performance potential.

But they do not. Not even close.

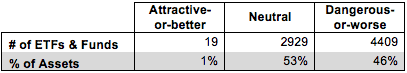

Figure 4 shows that 1% of ETF and mutual fund assets are allocated to funds with low costs and high-quality holdings according to my Predictive Fund Ratings, which are based on the quality of holdings and the all-in costs to investors.

Note the fund industry offers 4409 Dangerous-or-worse ETFs and mutual funds compared to just 19 Attractive-or-better ETFs and mutual funds, over 230 times more bad funds than good funds. That means a lot of fees are being paid to managers that do not deserve them.

Figure 4: Distribution of ETFs & Mutual Funds (Count & Assets) By Predictive Ratings

Source: New Constructs, LLC and company filings

Source: New Constructs, LLC and company filings

Investors deserve forward-looking ETF and mutual fund research that assesses both costs and quality of holdings. For example, BlackRock Funds: BlackRock Exchange Portfolio (STSEX) has Attractive total annual costs of 0.69%, but still manages to allocate over 44% of its assets to Attractive-or-better rated stocks. This fund is proof that investors can find low cost funds with good holdings.

The Boeing Company (BA) is one of my favorite stocks held by STSEX and earns my Attractive rating. Over the past decade, BA has grown after-tax profits (NOPAT) by 18% compounded annually and currently earns a return on invested capital (ROIC) of 13%. At ~$130/share, BA has a price to economic book value ratio of 1.6. For a company of BA’s quality, this valuation is cheap. If BA can grow NOPAT by 10% compounded annually for 15 years, the stock has a present value of $190/share. I like the potential upside for this solid stock.

Why is the most popular fund rating system based on backward-looking past performance?

I do not know, but I do know that the lack of transparency into the quality of portfolio management provides cover for the ETF and mutual fund industry to continue to over charge investors for poor portfolio management. How else could they get away with selling nearly 230 times more Dangerous-or-worse ETFs and mutual funds than Attractive-or-better?

John Bogle is correct – investors should not pay high fees for active portfolio management. His index funds have provided investors with many low-cost alternatives to actively managed funds.

However, by focusing entirely on costs, he overlooks the primary driver of fund performance: the stocks held by funds. Investors also need to beware certain Index Label Myths.

Research on the quality of portfolio management of funds empower empowers investors to make better investment decisions. Investors should no longer pay for poor portfolio management.

Kyle Guske II contributed to this report

Disclosure: David Trainer and Kyle Guske II receive no compensation to write about any specific stock, sector or theme.