Allergan (AGN), maker of Botox, continued its fight against the hostile takeover attempt by Valeant Pharmaceuticals (VRX) recently in a press release reiterating its belief that VRX’s acquisition-driven business model is unsustainable. The release contains quotes from notable hedge fund managers such as Jim Chanos and John Hempton that call VRX a roll-up.

The most interesting quotes, however, come from e-mails between Allergan and executives at Morgan Stanley (MS), which was aiming to get hired to advise Allergan. In one e-mail, an executive at Morgan Stanley wrote that one of his colleagues could “use his significant relationships with media and analysts to provide a clear and detailed articulation of why Valeant is a house of cards and your investors should not want to take the stock.”

Want to take a guess at which prominent investment bank has since been retained by that “house of cards?” Morgan Stanley reportedly is now advising Valeant on the acquisition despite the earlier misgivings of its executives.

Now, no one should be surprised that Morgan Stanley has switched sides on this deal. It’s their business to make money off an acquisition like this one, and it doesn’t matter which side pays them. Investors should view these e-mails from Morgan Stanley as a reminder that lots of people stand to make money of an acquisition of this size, and executives have many reasons to stretch the truth.

In particular, Valeant has been guilty of some dubious assertions in its attempts to defend itself from claims that its business model is nothing more than a rollup scheme and that its stock is overvalued.

Dubious Claim #1: VRX is fairly valued

One example of Valeant’s dubious storytelling comes from their Investor Relations page. On the “Advanced Fundamentals” tab, VRX compares its P/E ratio to its industry, sector, and the S&P 500. The table shows VRX’s P/E of 18 as comparable to the market as a whole and superior to its industry and sector.

What the table fails to mention is that VRX’s P/E is based off its adjusted, non-GAAP earnings, which removes billions of dollars in what it classifies as “one-time costs” related to its acquisitions. The P/E for the S&P 500, on the other hand, is based off of GAAP earnings that include these one-time costs, and the sector and industry P/E’s appear to be based the non-GAAP measures of each company in the sector or industry. Some of these non-GAAP metrics remove the same items as VRX, others don’t.

VRX is essentially lumping several different measurements under one label and pretending that these different metrics are comparable when they really are not. In addition to the fact that VRX excludes costs that other companies are including, its P/E also neglects the significant amount of debt that the company has taken on in order to finance its acquisition spree.

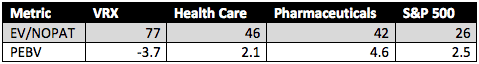

Figure 1 compares VRX to its sector, industry, and the S&P 500 on the basis of both price to economic book value (PEBV) and enterprise value/net operating profit after tax (NOPAT). Both of these metrics use comparable measurements of profit and incorporate the impact of debt on a company’s valuation.

Figure 1: True Valuation Comparison

Sources: New Constructs, LLC and company filings.

Sources: New Constructs, LLC and company filings.

We can see that from an Enterprise Value/NOPAT perspective VRX is significantly more expensive than its sector and nearly three times as expensive as the S&P 500. Even more strikingly, we see that VRX has a negative economic book value, which means that the perpetuity value of its current cash flow is worth less than its debt. VRX looks very expensive on this basis.

Dubious Claim #2: VRX’s past acquisitions are value creating

More importantly, some of VRX’s claims about the value creation of its acquisitions are dubious. Its track record over the past couple years at least don’t support this claim. Since 2009, VRX has increased its invested capital from $2.3 billion $26.8 billion, a nearly 13 fold increase. Over that same time, after-tax profit (NOPAT) has only tripled. As a result, return on invested capital (ROIC) has declined from 15% to 4%. That trend shows value destruction not creation. Companies often use earnings growth to paper over value destroying acquisitions.

The situation may be even worse than it appears, as our calculations assume that VRX is putting one-time expenses from its acquisitions in items such as “Restructuring, integration, and other costs,” which we exclude. John Hempton of Bronte Capital has argued that the company may be misclassifying recurring items as one-time charges in an attempt to boost its non-GAAP earnings.

Dubious Claim #3: Allergan bid is about long-term value, not short-term revenue growth

Valeant CEO J. Michael Pearson has referred to the proposed merger as “strategically compelling and enormously value-creating.” Perhaps Pearson has a different definition of “value-creating” than I do, as it’s hard for me to see a way that this acquisition can create value for VRX shareholders.

In order to create value for shareholders, a company must earn an ROIC greater than its weighted average cost of capital (WACC). At the proposed $53 billion price, AGN would need to earn a NOPAT of just over $4 billion in order for the ROIC on the deal to exceed VRX’s WACC of 7.6%.

Even if we take VRX’s optimistic assumption of $2.7 billion in cost savings as realistic, AGN would still come up just short of that $4 billion target. Any value creation from this deal would rest upon the assumption that VRX can strip AGN’s research budget to the core (as it has done with other acquisitions) and still achieve long-term profit growth, a questionable claim at the very least. If this acquisition works out as optimistically as VRX anticipates, it might just barely break even on an economic earnings basis.

If we look at the ramifications of this deal in comparison to VRX’s valuation, a similar picture emerges. With the increase in shares and debt from this deal, VRX would need to grow NOPAT by 27% compounded annually for 12 years in order to justify its $118/share valuation. This would include a 218% increase in NOPAT in year 1 of the acquisition. These outcomes are not likely and reflect the value at risk here.

VRX’s market value prices in a significant amount of growth for a company that is slashing R&D budgets left and right. VRX may be correct in its assertions that R&D spending in the U.S. is inefficient (though some of their claims on that point are questionable as well), but eliminating research spending altogether is not a good solution. VRX’s strategy of buying up companies to acquire new products is even less efficient per the trend in ROIC, and it can’t last forever, as the company eventually will run out of cash for these acquisitions because they cost more money than they make.

Unlike VRX, AGN has a strong business. It currently earns an ROIC of 20% and its economic earnings are positive and growing. The price VRX proposes to pay for AGN is very generous, but the fact that much of that price would be paid in the form of risky, overvalued VRX stock should give investors pause. AGN is a strong company, and it should resist being pulled into the unsustainable business model of VRX.

Sam McBride contributed to this report.

Disclosure: David Trainer and Sam McBride receive no compensation to write about any specific stock, sector, or theme.

2 replies to "Cutting Through Valeant’s Story"

Dubious indeed! Nice call.

Great long-term call! This is an extremely underrated article and is prescient. VRX capitulation is looming and it looks to be inevitable.