I think that most investors can agree that performing careful due diligence on an investment is a necessity. What investors cannot seem to agree on, though, is what constitutes “due diligence” and how to know what to look for.

The challenge here is that great amounts of time and expertise are required to analyze an annual report from cover to cover. These reports have become increasingly long and complex (see details in Justin Lahart’s Wall Street Journal article from earlier this year).

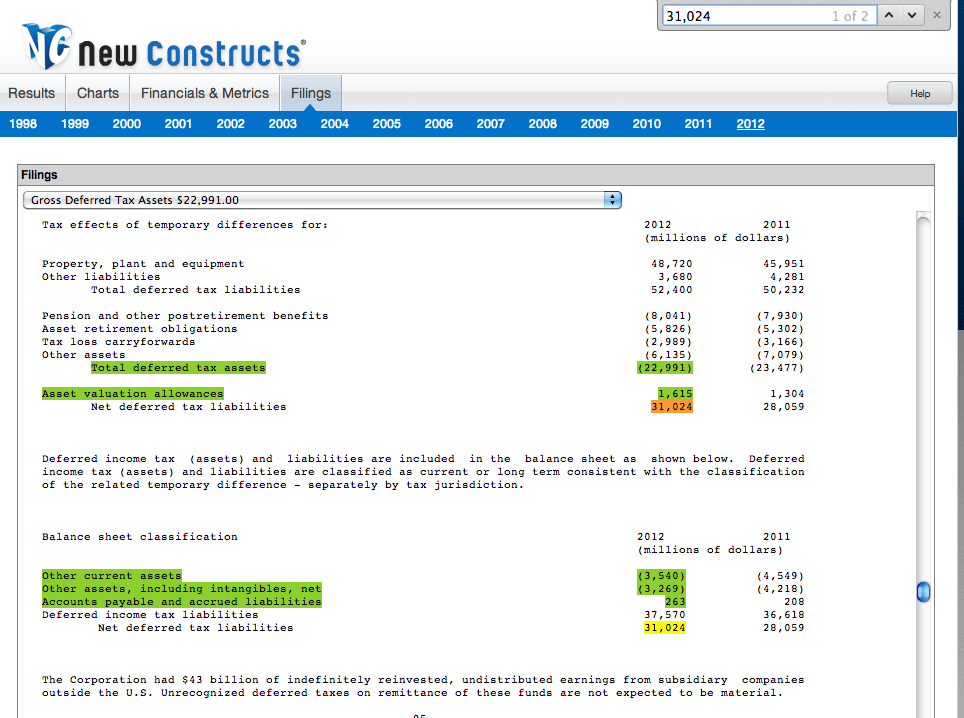

Adding to the challenge is that most of the length and complexity is not in the financial statements with which more people are familiar. It is in the financial footnotes and Management Discussion & Analysis (“MD&A”). We will refer to both as “footnotes” for the rest of this report.

Any assumptions that data in the “footnotes” is less important are false.

On the contrary, some of the most crucial financial data is contained in the footnotes. We’ve written reports on over 30 items from footnotes that dramatically distort a company’s reported profitability.

Quite often, footnotes reveal issues that can totally change one’s investment opinion.

How to Quickly See the Impact of Certain Footnote Adjustments on Your Current Investments

Companies often (and legally) “hide” certain items that effect net income in the footnotes. It’s there, you just need to dig in and find it. I know, I know, you don’t have the time or expertise — that’s why I am here to help. That’s why I started New Constructs. To put you on a level playing field against “them.”

A company’s net income under GAAP requires it to include many charges and income that have no bearing on the firm’s operating profitability.

We remove unusual items from net income to measure net operating profit after tax (NOPAT). NOPAT gives investors a better idea of the after-tax cash flows they can expect from the company going forward.

What Danger in The Footnotes Do You Need to Be Afraid of?

Have you ever heard of NOPAT before today?

Don’t worry, most investors haven’t — but here is where you separate yourself from the casual investor. Here is how you start to build conviction.

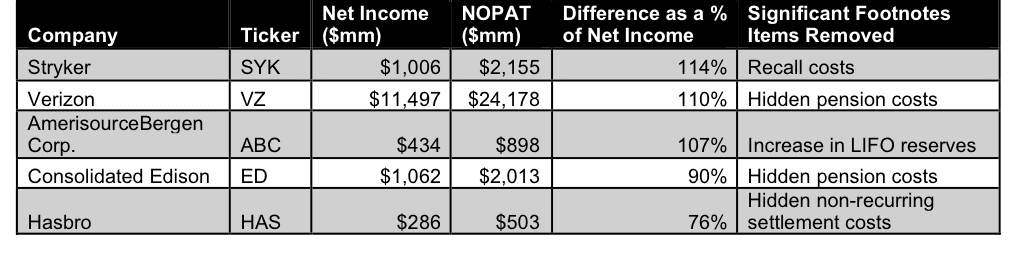

Often, NOPAT diverges significantly from net income. Figure 1 shows the five Dangerous-rated stocks in the S&P 500 with the most overstated net incomes in 2013 as a result of items found only in the footnotes.

Figure 1: Dangerous Companies With The Most Overstated 2013 Net Income Due To Footnote Items

Sources: New Constructs, LLC and company filings.

New Constructs does this work for you. We give you the final report so you can better understand if an investment risk is worthy of the potential reward.

Footnotes Can Reveal Good Things Too

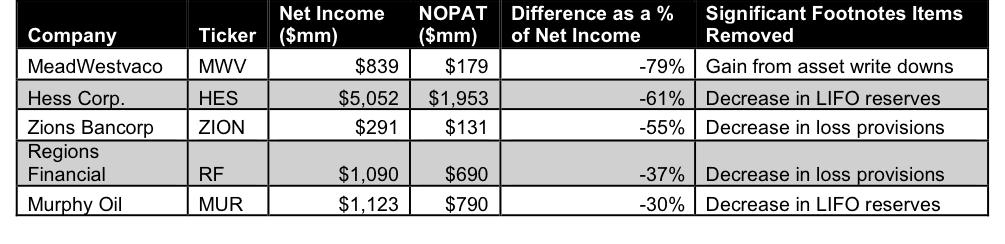

Footnotes can uncover hidden gems too. For example, unusual expenses bundled into the income statement line items can artificially lower net income. When these unusual expenses are removed from net income, operating profitability can be much higher than reported results suggest.

Figure 2 shows five Attractive-rated stocks that had the most understated net income as compared to NOPAT in 2013 as a result of items found only in the footnotes.

Figure 2: Attractive Companies With The Most Understated 2013 Net Income Due To Footnote Items

Sources: New Constructs, LLC and company filings.

The differences between net income and NOPAT as seen in Figure 2 are large, but not uncommon. In addition to the companies in Figure 2, 13 companies in the S&P 500 reported losses in 2013 but earned positive NOPATs thanks to unusual items found only in the footnotes. These companies include Alcoa (AA), CenturyLink (CTL), and Devon Energy (DVN).

According to its reported profits, Alcoa earned a GAAP loss of $2.3 billion in 2013, down from its 2012 reported profits of $189 million. However, Alcoa’s 2013 NOPAT was $841 million, up 24% over its 2012 NOPAT. This discrepancy was due in part to $460 million in hidden restructuring expenses buried in the footnotes.

The stock is up over 55% this year.

Stop and visualize the power in what you just learned. Standard reports showed a loss. We dug deeper into the footnotes and uncovered the actual story for you.

Why You Need Proper Due Diligence to Invest Intelligently

Lots of research firms talk about NOPAT, ROIC, cash flow, “EVA” and economic earnings. Very few firms take the time or have the expertise to gather the necessary information from footnotes to derive these metrics correctly.

Models are only as good as their inputs. Put garbage data in and you will get garbage results.

As a firm, we’ve studied footnotes for decades. We have developed proprietary technology to analyze footnotes and build our own database of financial data. We did that work to ensure we have the best data and best models for measuring cash flow and valuation in the business because we believe diligence matters.

And footnotes matter because they are the only source for data that is necessary to accurately calculate operating profitability.

Disclosure: David Trainer owns SYK. David Trainer and André Rouillard receive no compensation to write about any specific stock, sector, or theme.