The Information Technology sector ranks third out of the ten sectors as detailed in my Sector Rankings for ETFs and Mutual Funds report. It gets my Neutral rating, which is based on aggregation of ratings of 27 ETFs and 144 mutual funds in the Information Technology sector as of July 15, 2014. Prior reports on the best & worst ETFs and mutual funds in every sector are here.

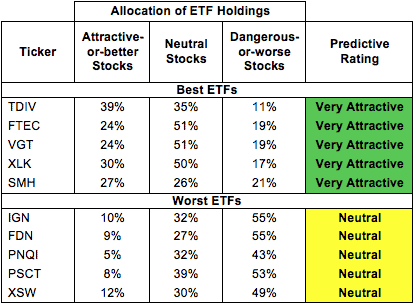

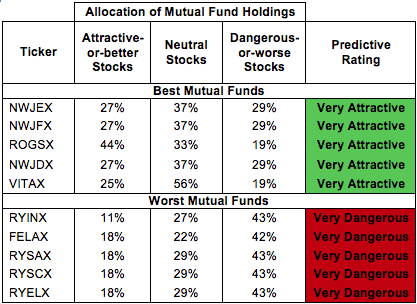

Figures 1 and 2 show the five best and worst-rated ETFs and mutual funds in the sector. Not all Information Technology sector ETFs and mutual funds are created the same. The number of holdings varies widely (from 24 to 425). This variation creates drastically different investment implications and, therefore, ratings. The best ETFs and mutual funds allocate more value to Attractive-or-better-rated stocks than the worst ETFs and mutual funds, which allocate too much value to Neutral-or-worse-rated stocks.

To identify the best and avoid the worst ETFs and mutual funds within the Information Technology sector, investors need a predictive rating based on (1) the stocks ratings of the holdings, (2) the all-in expenses of each ETF and mutual fund, and (3) the fund’s rank compared to all other ETFs and mutual funds. As a result, only the cheapest funds with the best holdings receive Attractive or better ratings. Investors need not rely on backward-looking ratings. My fund rating methodology is detailed here.

Investors seeking exposure to the Information Technology sector should buy one of the Attractive-or-better rated ETFs or mutual funds from Figures 1 and 2.

Get my ratings on all ETFs and mutual funds in this sector on my free mutual fund and ETF screener.

Figure 1: ETFs with the Best & Worst Ratings – Top 5

* Best ETFs exclude ETFs with TNAs less than $100 million for inadequate liquidity.

Sources: New Constructs, LLC and company filings

ProShares Ultra Semiconductors ETF (USD) is excluded from Figure 1 because its total net assets (TNA) are below $100 million and do not meet our liquidity minimums.

Figure 2: Mutual Funds with the Best & Worst Ratings – Top 5

* Best mutual funds exclude funds with TNAs less than $100 million for inadequate liquidity.

Sources: New Constructs, LLC and company filings

First Trust NASDAQ Technology Dividend Index ETF (TDIV) is my top-rated Information Technology ETF and Nationwide Mutual Funds: Nationwide Ziegler NYSE Arca Tech 100 Index Fund (NWJEX) is my top-rated Information Technology mutual fund. Both earn my Very Attractive rating.

State Street SPDR S&P Software & Services ETF (XSW) is my worst-rated Information Technology ETF and Rydex Series Funds: Electronics Fund (RYELX) is my worst-rated Information Technology mutual fund. XSW earns my Neutral rating and RYELX earns my Very Dangerous rating.

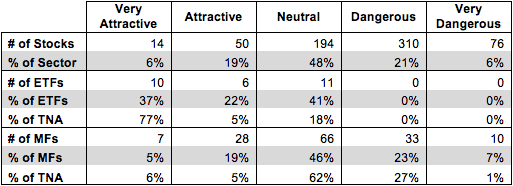

Figure 3 shows that 64 out of the 644 stocks (over 25% of the market value) in Information Technology ETFs and mutual funds get an Attractive-or-better rating. However, 16 out of 27 Information Technology ETFs (over 82% of total net assets) and 35 out of 144 Information Technology mutual funds (less than 11% of total net assets) get an Attractive-or-better rating.

The takeaway is: mutual fund managers allocate too much capital to low-quality stocks.

Figure 3: Information Technology Sector Landscape For ETFs, Mutual Funds & Stocks

Sources: New Constructs, LLC and company filings

As detailed in “Cheap Funds Dupe Investors”, the fund industry offers many cheap funds but very few funds with high-quality stocks, or with what I call good portfolio management.

Investors need to tread carefully when considering Information Technology ETFs and mutual funds, as some are better than others. Only 16 ETFs and 35 Information Technology mutual funds in the Information Technology sector allocate enough value to Attractive-or-better-rated stocks to earn an Attractive rating.

Amdocs Ltd. (DOX) is one of my favorite stocks held by Information Technology ETFs and mutual funds and earns my Very Attractive rating. Over the past decade, DOX has grown after-tax profit (NOPAT) by 11% compounded annually. The company current earns a 12% return on invested capital (ROIC) and has generated positive economic earnings every year for the last ten years. The best part is that even though the stock is up over 10% this year, investors haven’t missed their opportunity as DOX still remains undervalued. At its current price of ~$48/share, DOX has a price to economic book value (PEBV) ratio of just 1.1 This ratio implies the market expects DOX to only grow NOPAT by 10% for the remaining life of the company. This expectation seems awfully low given that the company has grown by 11% every year for the past 10 years. Investors should buy DOX before the market adjusts its expectations upward.

Sierra Wireless, Inc. (SWIR) is one of my least favorite stocks held by Information Technology ETFs and mutual funds and earns my Very Dangerous rating. SWIR has earned a negative NOPAT for the past three years and four of the last five. Despite this, the company is still valued for significant growth. To justify its current price of ~$29/share, SWIR must achieve pre-tax margins of 5% and grow revenue by 8% compounded annually over the next 14 years. Those expectations seem overly optimistic for a company with no recent track record of profitability.

525 stocks of the 3000+ I cover are classified as Information Technology stocks.

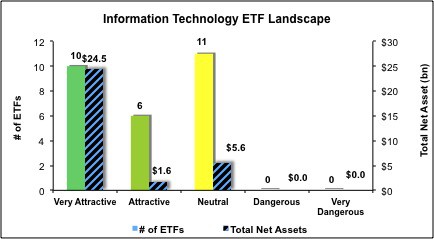

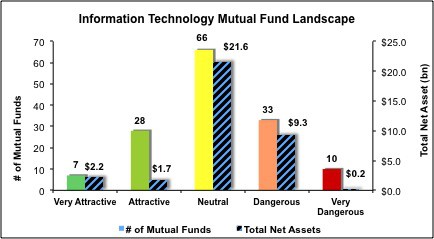

Figures 4 and 5 show the rating landscape of all Information Technology ETFs and mutual funds.

My Sector Rankings for ETFs and Mutual Funds report ranks all sectors and highlights those that offer the best investments.

Figure 4: Separating the Best ETFs From the Worst ETFs

Sources: New Constructs, LLC and company filings

Figure 5: Separating the Best Mutual Funds From the Worst Mutual Funds

Sources: New Constructs, LLC and company filings

Review my full list of ratings and rankings along with reports on all 27 ETFs and 144 mutual funds in the Information Technology sector.

Kyle Guske II contributed to this report.

Disclosure: David Trainer and Kyle Guske II receive no compensation to write about any specific stock, sector or theme.