Subscribers got access to this report one month early. SWIR is down 18% since this report was made available on 9/15/14. You can get access to all our actionable reports before they are made available to the public, along with Most Attractive, Most Dangerous Stocks or Best & Worst ETFs & Mutual Funds newsletters for $9.99/month.

Check out this week’s Danger Zone Interview with Chuck Jaffe of Money Life and MarketWatch.com

Sierra Wireless (SWIR: ~$30/share) is in the Danger Zone this week. Despite a few quarters of impressive revenue growth and a tripling of its stock price over the past two years, the company’s track record of profit growth is shaky at best. Sierra’s survival depends on maintaining leadership in a fast-changing business and a long-awaited trend that has yet to materialize: the widespread adoption of the “Internet of Things.” While the stock has been much-hyped by the Motley Fool, Sierra Wireless has been unable to grow profits or earn positive returns on capital over any meaningful amount of time and the stock’s valuation already reflects alarmingly high expectations for future profit growth.

How Unusual Income Items Mask Losses

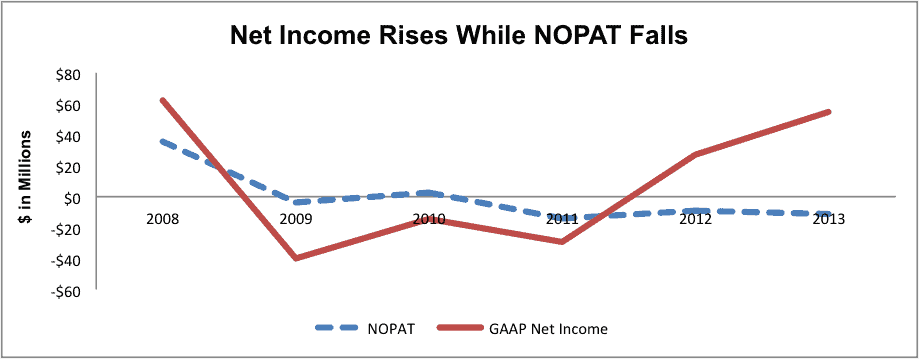

Sierra’s operating profit (NOPAT) has declined from $36 million in 2008 to a loss of -$12 million in 2013. Sierra’s operating losses over the past three years have led its return on invested capital (ROIC) to fall deeper into negative territory, from -3% in 2012 to -4% in 2013.

Figure 1 shows a problem: focusing on EPS leads to trouble. If investors looked only at Sierra Wireless’ reported income in 2013, they would be unaware of the company’s deepening losses over the last two years.

Sierra’s 2013 net income increased 102% over last year but this number provides a misleading picture. Much of this income was the result of a gain of over $70 million on the sale of Sierra’s AirCard business in 2013. This sale also boosted Sierra’s net income in 2012 to the tune of $31 million. Because this income is unusual, we remove it from our NOPAT calculation. After adding back another $4 million due of a number of other adjustments, we see that Sierra’s net income of $55 million exceeded its NOPAT by $67 million in 2013.

Figure 1: Focus On NOPAT, Not Net Income

Sources: New Constructs, LLC and company filings.

Sierra shows additional issues in its free cash flow, which has been negative in three of the past four years. Negative free cash flow by itself isn’t a bad thing, as it could mean that a company is making acquisitions that are helping to grow the business. However, Sierra’s declining NOPAT indicates that its 5 acquisitions since 2008 have hurt, not helped, its profitability.

Successful Investors Dig Deeper: Red Flags in the Footnotes

One of the favorite talking points of Sierra bulls is the fact that the company has no debt. The lack of claims on the company’s cash flow, bulls argue, allows Sierra to use its $158 million in excess cash to further invest in its business and make acquisitions.

However, this argument ignores several substantial liabilities. First, the company has $24 million in off balance-sheet debt. Another concern is Sierra’s over $22 million in outstanding employee stock option liabilities. Neither of these items are reported on the company’s balance sheet, despite being claims on future cash flows. These hidden liabilities alone are 9% of Sierra’s total assets and 5% its market cap.

Sierra also has accumulated asset write-downs of $56 million, or 15 cents for every dollar on its balance sheet. These write-downs are largely composed of abandoned technologies and products Sierra wrote down as they became obsolete. Write-downs are a sign of poor capital allocation and in this case, a fast-moving, unpredictable industry.

When Price Action Doesn’t Tell the Story: SWIR Success Hinges on a Long-Awaited Trend

According to a 2012 report, Sierra is the market leader in machine-to-machine (M2M) technologies. This term is used broadly to describe any communication between both wired and wireless machines. M2M is considered to be an integral part of the “Internet of Things,” (IoT) which refers to the interconnectivity of computing devices on the Internet. A simple example is the communication between a cell phone and wireless thermostats.

By providing chips to OEM manufacturers that allow the product to connect to the Internet, or 3G/4G service, Sierra would appear to have carved itself an ideal position in the industry. While Sierra currently has a market share lead, ahead of main competitors Telit and Intel-backed Cinterion, it must execute perfectly going forward to maintain and not lose any advantages to much bigger and better-equipped competitors.

Large chipmakers like Intel (INTC), and Qualcomm (QCOM) are developing M2M technologies of their own, as well as services to attract more users to the IoT. Companies like Cisco (CSCO) that currently purchase Sierra’s chips may also follow Apple (AAPL) and Samsung’s lead and begin producing their own chips. These companies all have more capital to deploy, larger R&D, and provide their own IoT solutions to companies around the world.

Another question surrounding Sierra’s business is the adoption of the Internet of Things itself. So far, wireless thermostats, light bulbs, and other household appliances have been slow to catch on, despite their availability (perhaps due to their cost — $800 outfit a home with smart smoke detectors). Manufacturers have begun integrating connectivity within cars, planes and engines, but predictions vary widely as to when the IoT will truly reach the mainstream. As the concept is gaining more attention, companies have already begun dividing up the market, similar to the VHS vs. Betamax conflict.

The IoT has been discussed in its earliest form since 1994, but has yet to materialize. It is all well and good if Sierra Wireless can continue leading in the M2M category, but if the category fails to grow as hoped, there is little reason to be optimistic about the company’s future.

What is an Ideal Valuation for SWIR?

The hype around SWIR has driven the stock price up 127% over the past year. However, with a lack of profits and a highly uncertain future, SWIR looks greatly overvalued.

To justify its current valuation of ~$30/share, Sierra must immediately become profitable and raise its pre-tax margins from -3% to 5% (its average positive before-tax margins over the past decade). Sierra must then grow revenue by 20% compounded annually for the next 8 years. If we lower the company’s future revenue growth to a more reasonable 15% compounded annually, the company will need 12 years of this level of growth to justify $30/share.

On the other hand, if the company is able to grow revenue at 10% annually for 8 years, closer to the 6% growth the M2M market saw in 2013, the stock is worth $16/share — 45% downside from its current price.

Sierra’s operating losses in 4 of the past 5 years despite the rise of the IoT do not make me confident that the company will be able to achieve this kind of impressive and sustained profit turnaround and growth. In addition, new competition from Chinese module makers Huawei and ZTE will put downward pressure on Sierra’s margins.

The dangers of this stock’s overvaluation have already been seen this year. SWIR dropped 10% on May 2 after missing on EPS, despite beating quarterly revenue estimates and offering above-consensus quarterly revenue guidance. This company must outperform in every way into the foreseeable future for its valuation to be justified. This is a scenario I’d rather not bet on, especially when considering the company’s competition and its history of questionable capital allocation detailed above.

André Rouillard and Kyle Guske II contributed to this report.

Disclosure: David Trainer, André Rouillard and Kyle Guske II receive no compensation to write about any specific stock, sector, or theme.

Photo credit: Josh Hallett (Flickr)

1 Response to "Danger Zone: Sierra Wireless (SWIR)"

SWIR down 15% as company warns of softer demand in the second half of 2016 and guidance comes in at low end of expectations. SWIR now down 52% since our original Danger Zone