Don’t Trust This Utility’s Dividend

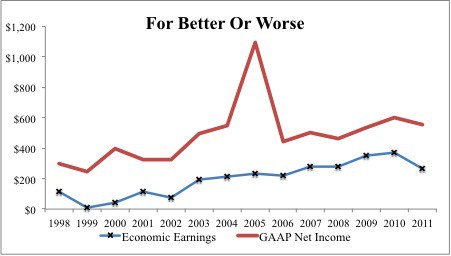

Smart investors consider more than just the dividend of a stock. They also consider the principal risk. If the principal risk is greater than the dividend yield then the dividend is of no real value. I see the principal risk of this stock at more than 15% with a fair value closer to $50 – after adjusting for the pension accounting shenanigans.

David Trainer, Founder & CEO