Investment Style Rankings For ETFs, Mutual Funds & Stocks

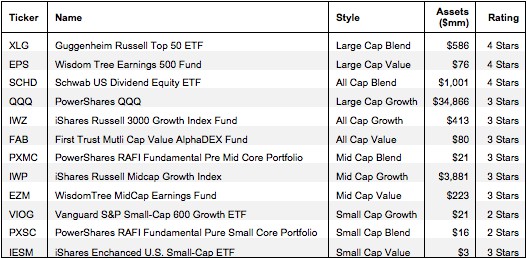

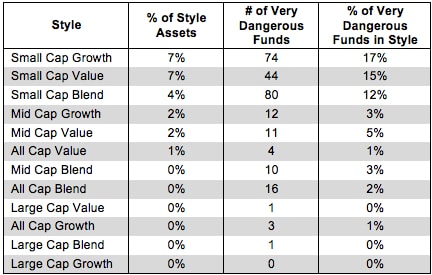

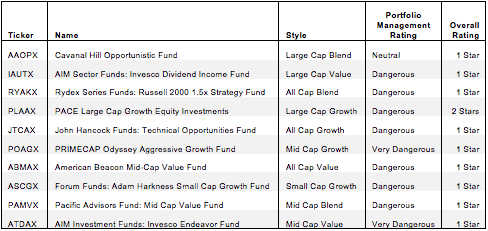

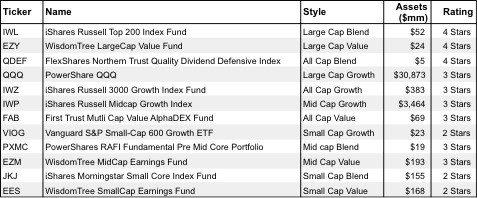

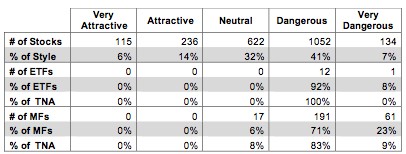

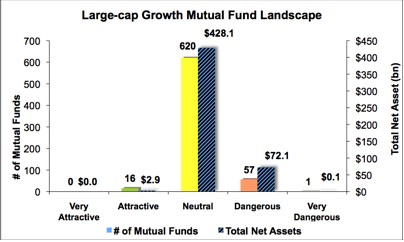

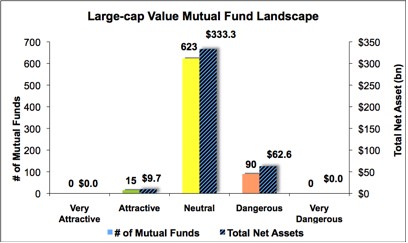

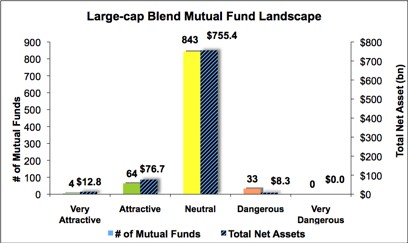

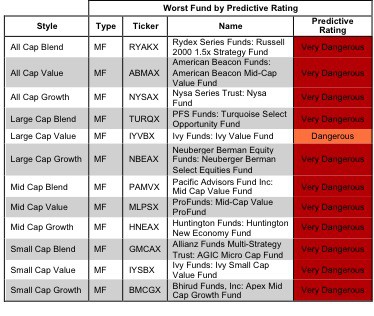

At the beginning of the third quarter of 2014, only the Large Cap Blend style earns an Attractive rating. My style ratings are based on the aggregation of my fund ratings for every ETF and mutual fund in each style.

David Trainer, Founder & CEO