Getting the Footnotes Data to Calculate Core Earnings During 10-K Filing Season

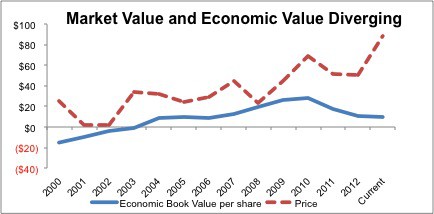

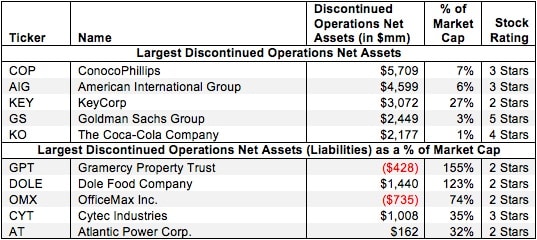

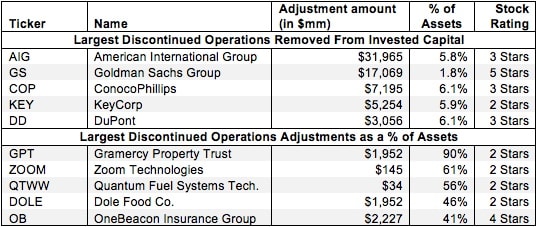

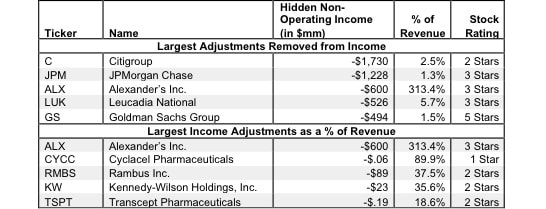

This week’s Filing Season Finds report highlights how hidden and reported unusual items can materially understate true profits.

Kyle Guske II, Senior Investment Analyst, MBA