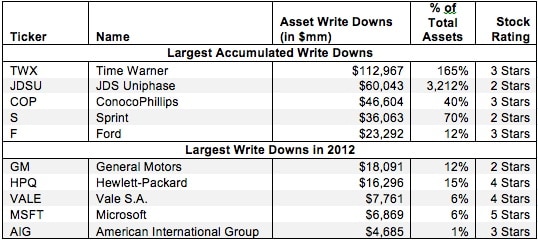

Asset Write-Downs – Invested Capital Adjustment

For debt investors, which GAAP was primarily designed for, write-downs are analytically helpful. They provide a more accurate assessment of the liquidation value of a company’s assets. For equity investors, on the other hand, write-downs are not helpful because they distort the return on invested capital (ROIC) of a company.

David Trainer, Founder & CEO