Why Suitors Are Leaving Twitter at the Altar – Danger Zone

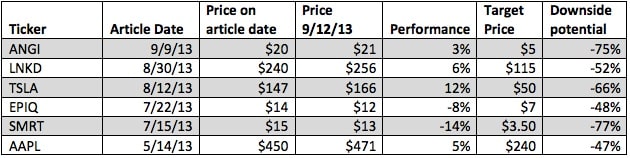

Today’s news that Alphabet, Apple, and Disney are unlikely to bid for Twitter should come as no surprise. We think these companies (and many investors) are doing the same work we have done and simply cannot stomach paying anywhere close to Twitter’s current price.

Kyle Guske II, Senior Investment Analyst, MBA