Introducing the Stock Tracker 50 Membership

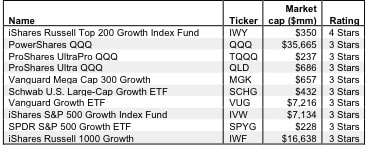

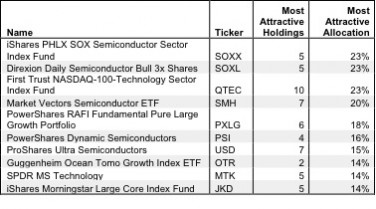

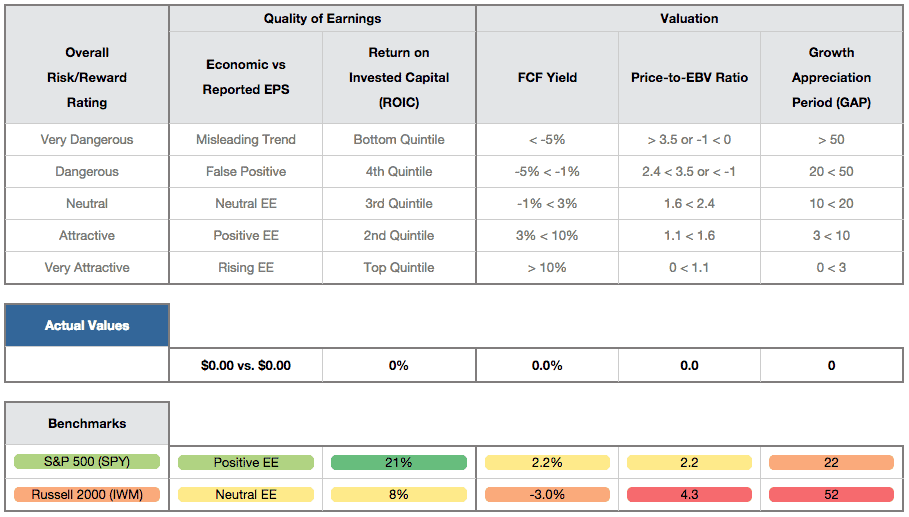

We’re excited to announce Stock Tracker 50. This new membership offers streamlined access to our Stock, ETF, and mutual fund ratings.

Kyle Guske II, Senior Investment Analyst, MBA