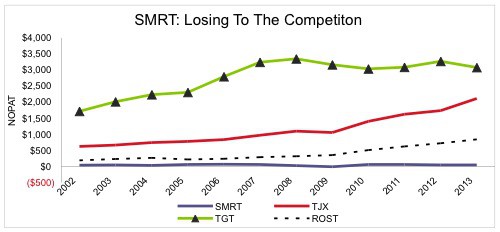

Position Close Update: Taking Another Winner Off the Table

The company must outperform optimistic assumptions for the stock to offer upside to investors.

Hakan Salt, Associate Investment Analyst